Marketing 101: What Is Audience Research?

September 8, 2025

Introduction

Marketing success in 2025 hinges on one fundamental principle: know your audience. Audience research – the process of gathering and analyzing information about the people you want to reach – is the key to creating campaigns that truly connect.

Without it, you’re essentially flipping a coin and hoping for the best. In this comprehensive guide, we’ll explore what audience research is, why it’s so critical, and how to do it right. By the end, you’ll see how understanding your audience on a deeper level can transform your marketing strategy and drive growth.

What Is Audience Research?

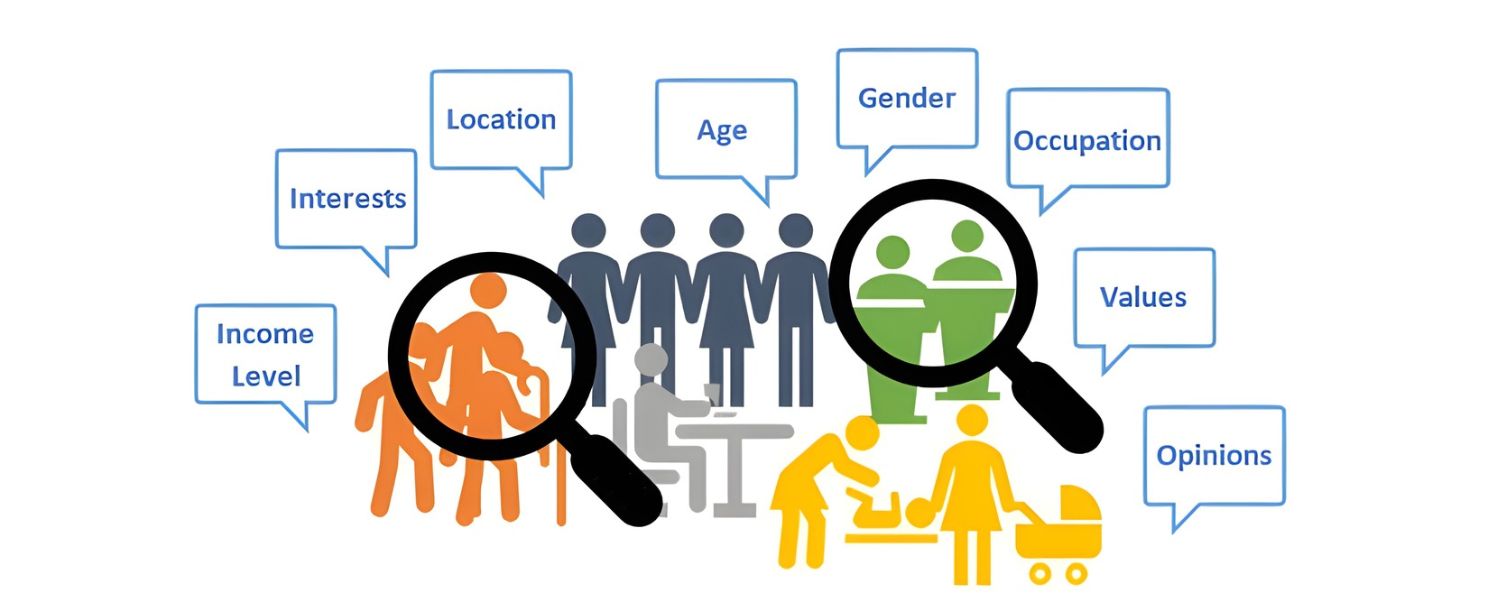

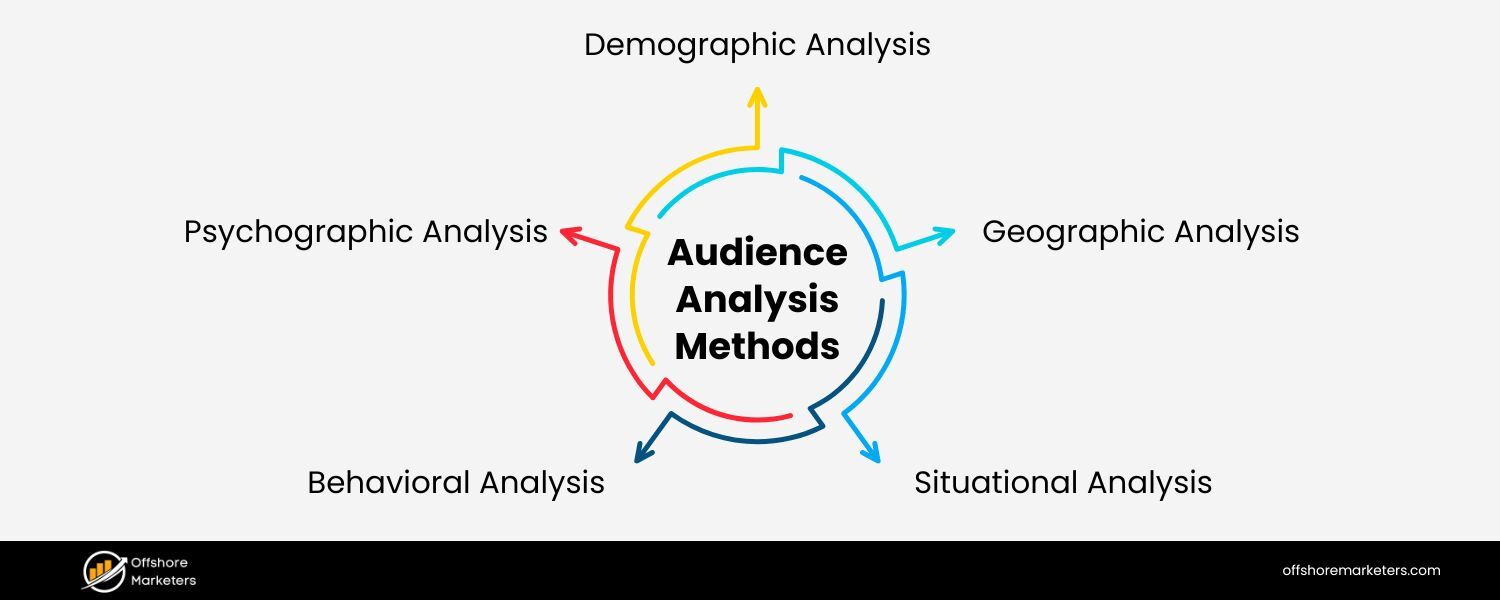

Audience research is how businesses get to know their target customers – their demographics, behaviors, needs, and pain points. In simple terms, it means studying the people you want to reach, so you can tailor your marketing to their interests and challenges. This goes beyond basic demographics; modern audience research digs into psychographics, context, mindset, and culture to paint a rich picture of who your audience really is.

Often, the term “audience research” is used interchangeably with “market research.” However, there’s a subtle difference. Market research looks at the broader market environment – competitors, pricing, industry trends – whereas audience research focuses specifically on people or segments and their attitudes, behaviors, and habits.

In fact, audience research is sometimes called audience understanding research because it aims to understand the people behind the numbers. Ultimately, both are complementary: to succeed you should understand both your market and the audience within it.

Why Audience Research Matters

In an age of information overload and endless options, consumers expect marketing that speaks directly to them. Conducting audience research provides insights that help your business achieve its goals faster and more efficiently, leading to improved customer acquisition, retention, and even revenue growth.

Here are some core benefits of investing in audience research:

1. Deeper Connection and Empathy

By learning your audience’s average age, interests, pain points, and preferences, you start to see them as real people rather than abstract “leads”. This deeper understanding lets you craft messaging and content that truly resonates.

Marketers who know how their audience thinks, feels, and lives can connect on a more human level. As one expert put it, “There’s no substitute for personally watching and listening to real people.” Understanding your customers’ reality is invaluable.

2. Informed Decision-Making

Good audience research takes the guesswork out of marketing. It can reveal what interests your audience, who influences them, what problems they face, and how they view your product or brand.

With data-backed insights, you can prioritize the right features to develop, choose effective marketing channels, and craft messages that hit the mark. In fact, research often uncovers opportunities and gaps – for example, revealing why competitors aren’t connecting with a certain group and how you can fill the void.

3. More Effective Campaigns

When you know exactly who you’re talking to, you can create marketing campaigns that feel custom-made for that audience. Audience research helps you segment your audience into meaningful groups with shared characteristics.

You can then tailor content and offers to each segment, dramatically increasing relevance. The result? Higher engagement and conversion rates, because people feel understood.

One major benefit is being confident that your campaigns are directly relevant to your target audience, since they’re based on data from the people you aim to reach.

4. Customer-Centric Innovation

Audience research isn’t just about marketing – it can guide product development and customer experience as well. By gathering feedback and listening to what your audience wants or doesn’t want, you ensure you’re building something desirable.

Organizations that depend on audience participation (like membership or community-driven companies) have learned that without research, internal assumptions reign – and those often miss the mark.

Using research to test your hypotheses prevents wasted investment on features or content no one asked for. In short, it helps you stop guessing and start making evidence-based decisions.

5. Competitive Advantage

Finally, audience insights become a competitive advantage. Many agencies or businesses skip or skim on research due to budget or time pressures, relying on gut feeling or copying competitors’ tactics.

That opens the door for you to outperform them by knowing the customer better. In the words of a seasoned strategist, “Marketing without understanding the motivations of the people you’re selling to is like throwing spaghetti at the wall to see what sticks.” Doing the “hard work” of research upfront can set your brand apart in a big way.

In summary, audience research makes your marketing more personal, data-driven, and effective. It ensures you’re speaking the right message to the right people, rather than shouting into the void. Now, let’s look at how to actually do it step by step.

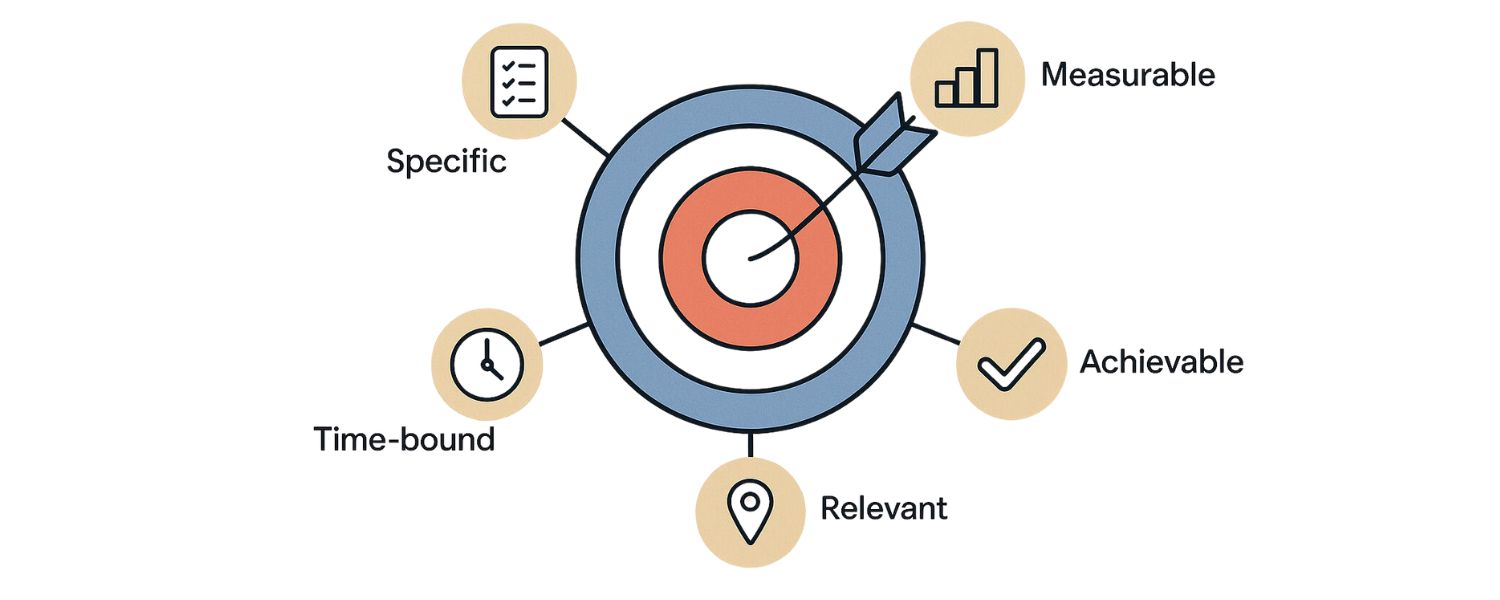

Before You Start: Define Your Goals and Questions

Successful audience research starts with a clear plan. Before jumping into surveys or interviews, take time to define what you need to learn. Ask yourself: What am I ultimately trying to achieve with this research? What decisions will it inform?. Pinpointing your goals will guide the entire project – from who you target to what questions you ask.

Begin by distilling your business problem or marketing challenge into a concise statement. For example, maybe your goal is “Understand why our customer engagement is dropping among Millennials.” Once your core question is defined, break it down further:

1. Key questions to answer

List out the specific things you need to know. For instance: What are Millennials’ needs and expectations? What problems are they facing with our product? Which channels do they prefer for engagement? Being specific helps ensure each research question ties back to your ultimate goal.

2. Stakeholder input

If you work in a team or organization, gather input on what insights different departments need. Sometimes sales, product, or customer service teams have burning questions about the audience.

However, be careful of “question creep” – don’t overload your research with tangential inquiries that won’t drive action. Stay focused on “need-to-know” information, not just “nice-to-know.”

Critically, make the habit of asking “So what?” for each potential question. If you can’t envision how knowing that piece of information will influence your strategy or tactics, then it might not be worth asking.

Keeping your research tightly focused will not only yield more useful data, it also shows respect for your respondents’ time by keeping surveys or interviews succinct. Ultimately, a well-defined research goal is the North Star that keeps your audience research on track.

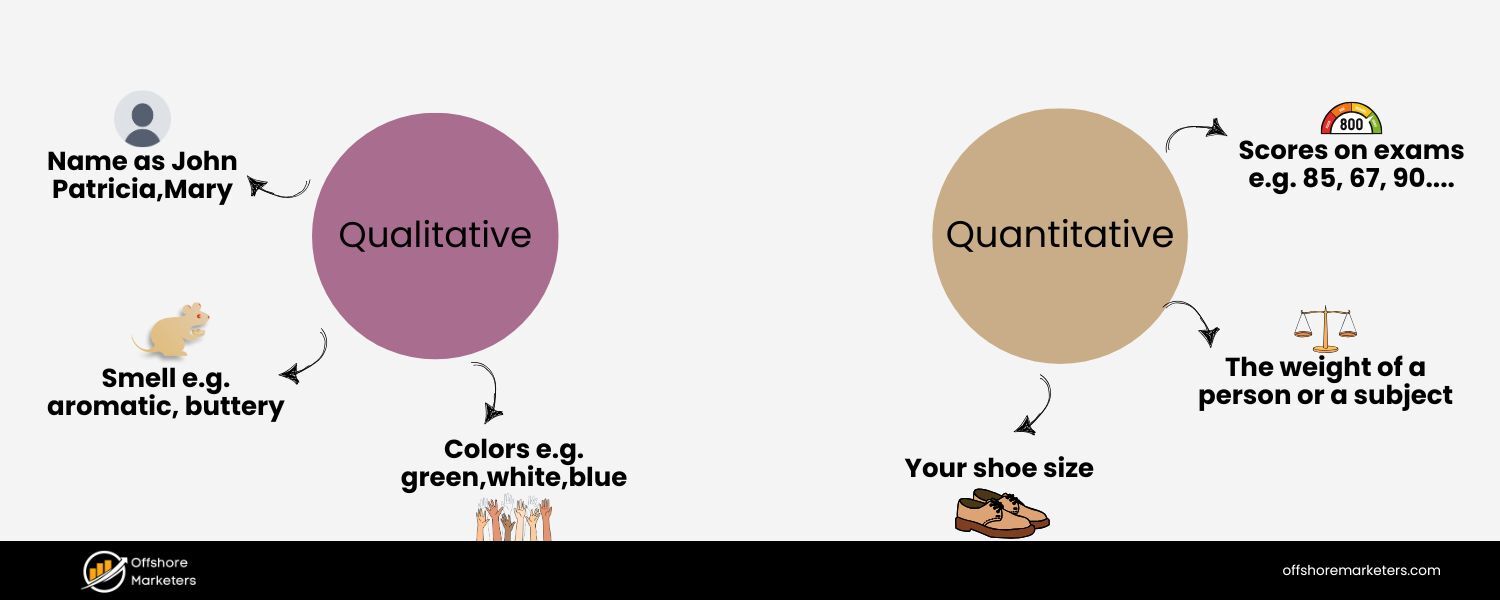

Qualitative vs. Quantitative Research

Audience research can take many forms, but most methods fall into two broad categories: qualitative and quantitative research. Each serves a different purpose, and the best insights often come from using a mix of both.

1. Qualitative Research

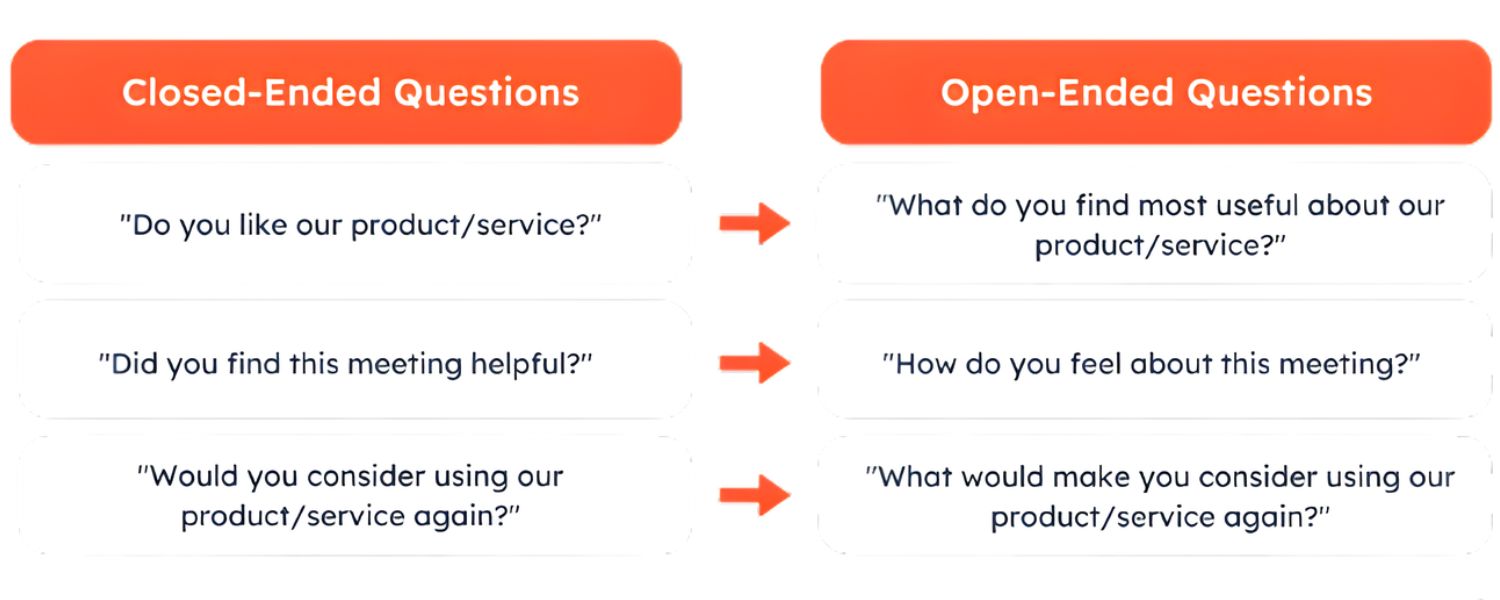

This is all about the why. Qualitative methods explore attitudes, emotions, motivations, and deeper insights that numbers alone can’t capture. Techniques include in-depth interviews, focus groups, open-ended survey questions, ethnographic studies, and observation.

For example, conducting one-on-one customer interviews (by phone or in person) lets you hear customers describe their challenges and feelings in their own words. You might discover unexpected motivations or pain points through these free-form conversations.

Qualitative research tends to involve smaller samples but yields rich, nuanced understanding. It’s ideal for uncovering themes and ideas – the stories behind the statistics.

2. Quantitative Research

This is about the what, how many, how often. Quantitative methods gather measurable data and statistics about your audience. Common techniques include surveys with closed-ended questions, polls, and analysis of numerical data like webaudiencesite analytics or purchase records.

For instance, your web analytics can tell you what percentage of your users are mobile vs. desktop, or a survey can quantify how many customers prefer Feature A over Feature B. Quantitative research typically involves larger sample sizes and yields data that can be analyzed for patterns or percentages. It’s perfect for building an accurate demographic profile, measuring satisfaction levels, or tracking behavioral trends over time.

Both approaches are valuable. Qualitative research finds meaning and reasons, while quantitative confirms scope and frequency. Used together, they provide a full picture: the stories and the stats.

For example, you might start qualitatively (say, a few interviews or open-ended questions) to identify key themes, then design a quantitative survey to validate how widespread those sentiments are across your whole audience.

Or vice versa – a survey might reveal an unexpected data point that you then investigate through follow-up interviews to understand why that trend exists. Savvy marketers often combine both methods in an iterative cycle. This way, you get depth of insight and statistical confidence, each approach informing the other.

Proven Audience Research Methods and Techniques

With your goals defined and a grasp of qual vs. quant, let’s explore some common audience research methods. Depending on your objectives and resources, you might use one or several of these techniques:

1. Leverage Existing Data (“Secondary Research”)

Before reinventing the wheel, see what insights you already have or can access from existing sources. This is known as secondary research – using data or research that’s already been collected by others.

Start internally: look at your metrics and customer data. Your website analytics, social media stats, CRM database, or past survey results can reveal a lot about your audience’s behavior and preferences. For instance, product usage logs might show which features customers use most, or email data might tell you which content topics get the most clicks.

Also, check for any industry research or reports on your target market. There may be published studies, whitepapers, or databases (from sources like Statista, Pew Research, or trade associations) that answer some of your questions.

In a newsroom or membership context, for example, teams begin by reviewing annual reports and research on their subject area. Utilizing existing research first can save time and highlight knowledge gaps to explore further. The key is to build on what is already known before conducting new research from scratch.

2. Surveys and Questionnaires

Surveys are one of the most popular audience research tools – for good reason. They allow you to reach a large sample with structured questions and gather quantitative data quickly.

Surveys can be done via online forms, email, phone, or even in-person. A well-designed survey can answer questions like “Which of these features is most valuable?” or “How satisfied are you with our service (scale 1-10)?” Surveys are versatile: you can include multiple-choice questions, ratings, rankings, and a few open-ended questions for qualitative insight. They are especially useful for collecting specific feedback or measuring metrics across a broad group.

To get reliable results, be mindful of who you survey and how you phrase questions. Ensure your sample represents the audience you care about. For example, if you run an independent school, surveying people with no children about school programs will yield irrelevant opinions – those people aren’t making schooling decisions.

You’d want to focus on parents of school-aged children in that case. Similarly, use neutral, unbiased wording to avoid leading respondents. Keep surveys as concise as possible, since long or unfocused questionnaires can cause respondents to disengage and hurt data quality. When done right, surveys provide statistically meaningful insights on questions that matter.

Tip: Many tools make surveying easier – from simple ones like Google Forms to robust platforms like SurveyMonkey or QuestionPro Audience. Some even offer panels of respondents so you can target niche demographics quickly.

3. Customer Interviews

There’s nothing quite like sitting down (or hopping on a call) with a customer and having a conversation. Interviews let you dive deep into individual experiences and gain context that surveys can’t capture.

These are quintessential qualitative method – best for exploring motivations, emotions, and open-ended feedback. For example, a series of customer interviews might reveal why users prefer a competitor’s product, or uncover language they use to describe their problem (gold for crafting marketing messages!).

One experienced marketer noted that spending time one-on-one with customers resulted in insights and even wording that a client continued to use a decade later. That’s the power of a good interview.

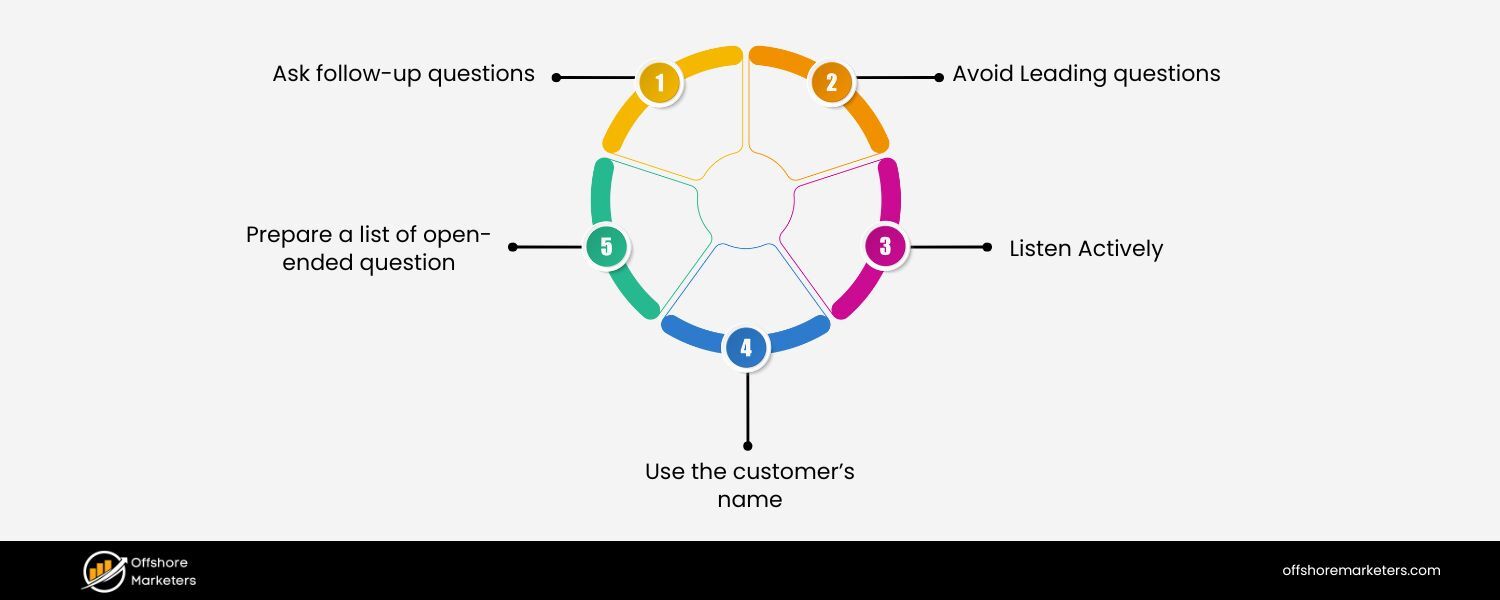

When conducting interviews, plan a loose discussion guide with key topics, but allow the conversation to flow naturally. Ask open-ended questions like “Can you walk me through how you decided to purchase our product?” and follow up with “why?” to dig deeper.

Often, the real gems come from unexpected tangents or stories the interviewee shares. Aim to interview a diverse cross-section of your audience (e.g. a mix of happy and unhappy customers, or different buyer personas) to get varied perspectives.

While interviews take more time and effort than a mass survey, the rich detail and human stories you gain can deeply inform your strategy and inspire more empathetic marketing.

4. Focus Groups

If you want qualitative feedback from multiple people at once, consider running a focus group. In a focus group, you gather a small group (usually 5–10 individuals) from your target audience and moderate a discussion on specific topics.

This format is great for brainstorming reactions to a concept, exploring group dynamics (like how people influence each other’s opinions), or getting quick input on several ideas.

For example, a focus group might involve showing two ad concepts to participants and discussing their responses. It provides more nuance than a survey, yet is more time-efficient than one-on-one interviews because you hear from several people in a session.

Focus groups do require careful moderation to ensure everyone’s voice is heard and no one dominates the conversation. You’ll want prepared questions to guide the discussion, but also the flexibility to probe interesting comments further.

The interactive nature of focus groups can spark ideas – participants may build on each other’s points or debate, revealing insights into attitudes and group perceptions. While the findings aren’t statistically representative, focus groups can quickly surface common themes and why people feel a certain way.

They serve as a useful middle ground when you need more depth than a survey can offer, but still want input from multiple individuals efficiently.

5. Social Listening and Online Behavior Analysis

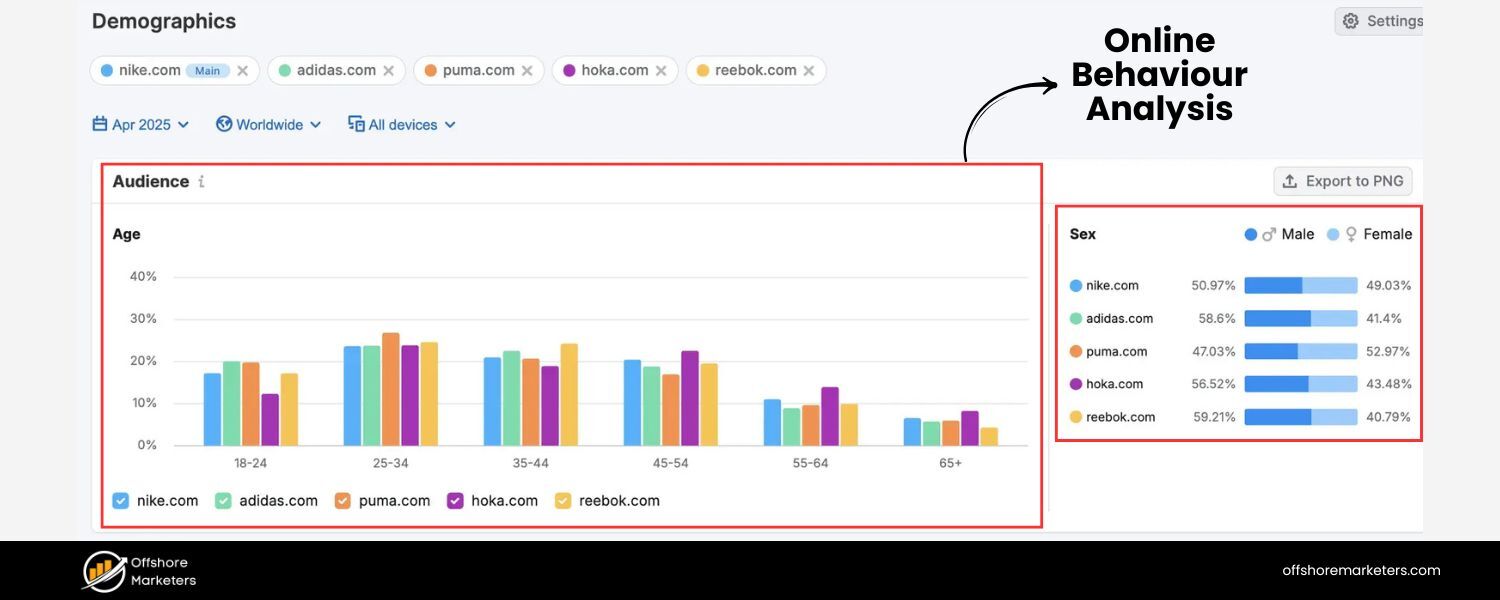

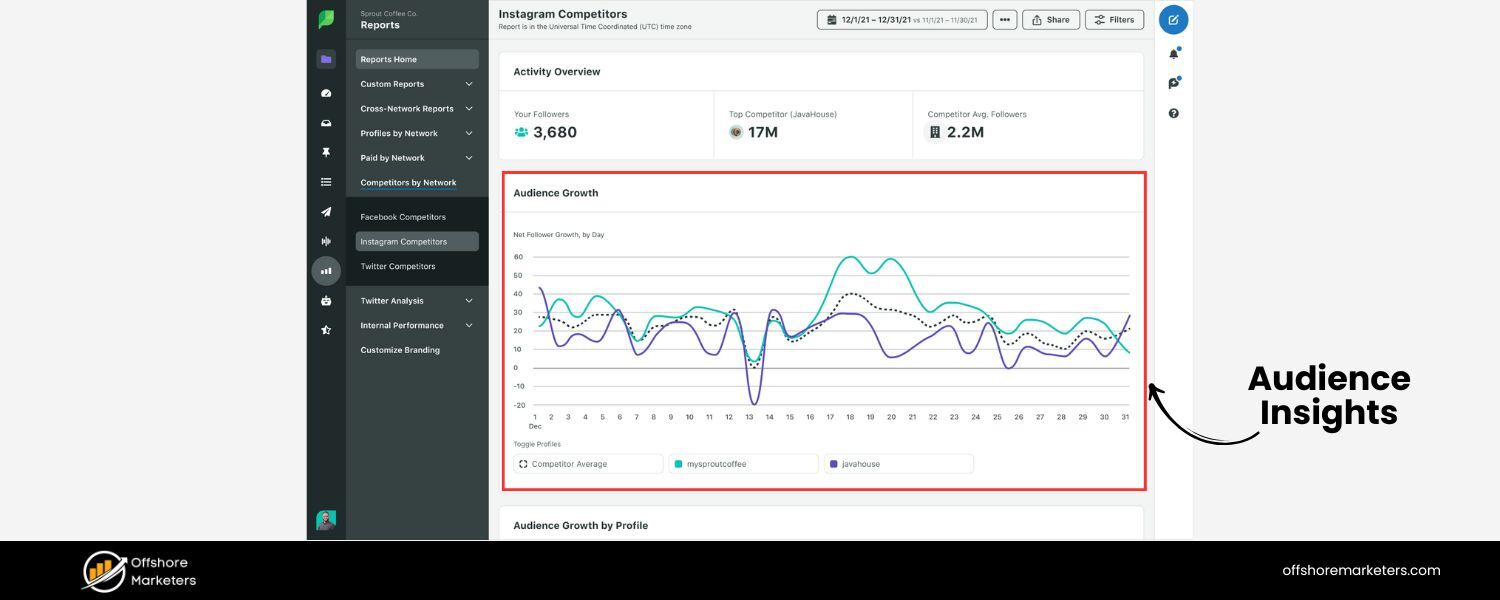

In the digital era, a lot of audience insight can be gathered by observing online behavior and conversations. Social listening tools (like Brandwatch, Sprout Social, or Hootsuite) allow you to monitor what people in your target audience are saying on social media, forums, or review sites.

By tracking mentions of your brand, competitors, or keywords related to your niche, you can discover common praises, complaints, questions, and trending topics among your audience. This is essentially audience research via eavesdropping – in a good way. It’s a quick path to specific insights and a key component of many modern audience research efforts.

For instance, analyzing comments on your competitors’ social media posts might highlight pain points their customers have – which your product could potentially solve. Or listening to discussions in a Reddit community of your niche could reveal the language and memes your audience uses, helping you strike the right tone. Social listening can also alert you to shifts in sentiment or emerging needs before they become obvious (spotting trends early).

In addition to conversations, look at behavioural analytics: your website and app analytics, email engagement data, search query data, etc. These quantitative sources show what people do, which complements what they say.

For example, seeing that a majority of visitors drop off at a certain page might prompt you to research what information they’re not finding. Tools like Google Analytics, heatmap trackers, or audience insight platforms (such as GWI or SparkToro) can reveal where your audience spends time online and how they interact with content. By combining social listening and digital analytics, you get an on-the-ground view of audience behaviour in real time.

6. Competitive Analysis (for Audience Insights)

Analyzing your competitors can indirectly teach you about your audience. If you examine who competitor brands are targeting and how, you might identify segments you’ve overlooked or messaging that isn’t resonating.

Competitive analysis in this context involves looking at competitors’ marketing materials, social media engagement, reviews, and any available data on their customer bases. Are there customer segments they cater to that you haven’t tapped? What kind of people engage positively with their campaigns, and where do competitors seem to be missing the mark?

For example, you might find through reviews that customers love a competitor’s product but complain about poor support – indicating an opportunity for you to differentiate by emphasizing customer service.

Or you might observe that none of your competitors are targeting a fast-growing niche community online. This kind of insight helps you spot “white space” opportunities and shifting attitudes in the market.

Competitive analysis, combined with your own research, can validate which audience needs are unmet and how you can position your brand to meet them better.

7. Personal Development and Journey Mapping

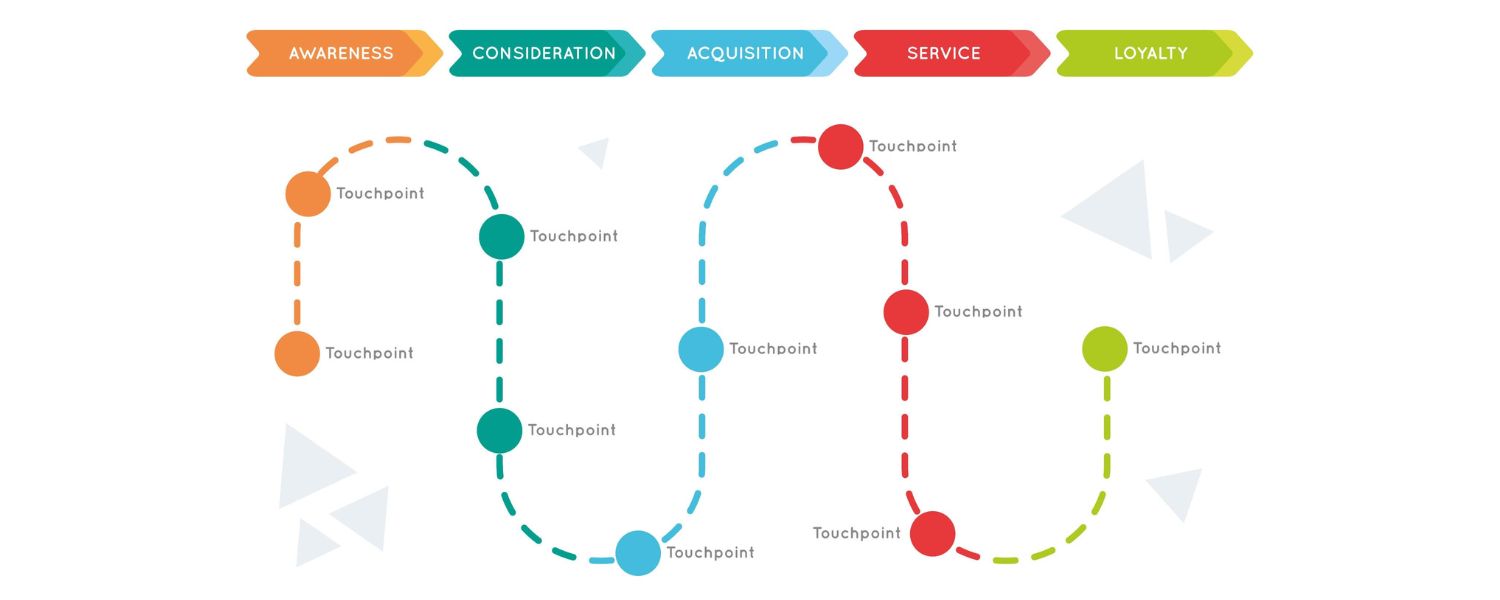

While not a method per se, it’s worth mentioning what you do with all these research findings: often, the outcome is to create buyer personas and map customer journeys. A buyer persona is a semi-fictional profile representing a key segment of your audience – including demographics, interests, goals, challenges, and even a name or avatar to humanize them.

Many companies choose to create a persona after conducting audience research as a way to synthesize insights into an actionable reference. For instance, you might develop “Marketing Manager Mary,” a persona that encapsulates the traits of your B2B software’s target users, based on interview and survey data. Personas help ensure everyone on your team keeps the real audience in mind when developing campaigns or products.

Additionally, mapping out the customer journey – the steps and touchpoints a person goes through from initial awareness to purchase and beyond – can highlight where audience research insights apply.

Maybe your research showed that potential customers struggle to find credible information in the consideration stage; that indicates you should create more educational content or comparisons at that step.

Or if you learned that trust is a big issue, you might add testimonials and reviews into the journey. Using your research to inform each stage of the customer experience ensures you are meeting audience needs at every turn.

Best Practices for Effective Audience Research

As you implement these methods, keep a few best practices in mind to maximize the quality and impact of your audience research:

1. Ensure Representative Samples

To trust your data, talk to the right people. Define the characteristics of your target audience (age, region, role, etc.) and use sampling techniques that reflect those characteristics.

Avoid convenient but skewed samples – for example, surveying only your current users might miss insights from potential customers who chose a competitor. Sometimes you may need to use panels or third-party services to reach a specific demographic.

The goal is to gather input that truly represents the audience you want to understand, so your findings aren’t biased by an unbalanced group.

2. Ask the Right Questions (and Listen)

Crafting good questions is an art. Keep wording neutral and clear, and tailor questions to the respondent’s context. Don’t ask someone questions that don’t apply to them (as the school example illustrated).

During qualitative research, be a good listener – sometimes the most important insights come from a comment the person makes in passing. Follow up with “Why?” and “Can you tell me more about that?” to peel back layers. And as Larry Page wisely noted, there’s no substitute for personally observing real people.

Whenever possible, witness your audience’s behavior directly – whether by watching usability tests, visiting a store, or scrolling through their social media discussions. It will ground your understanding in reality.

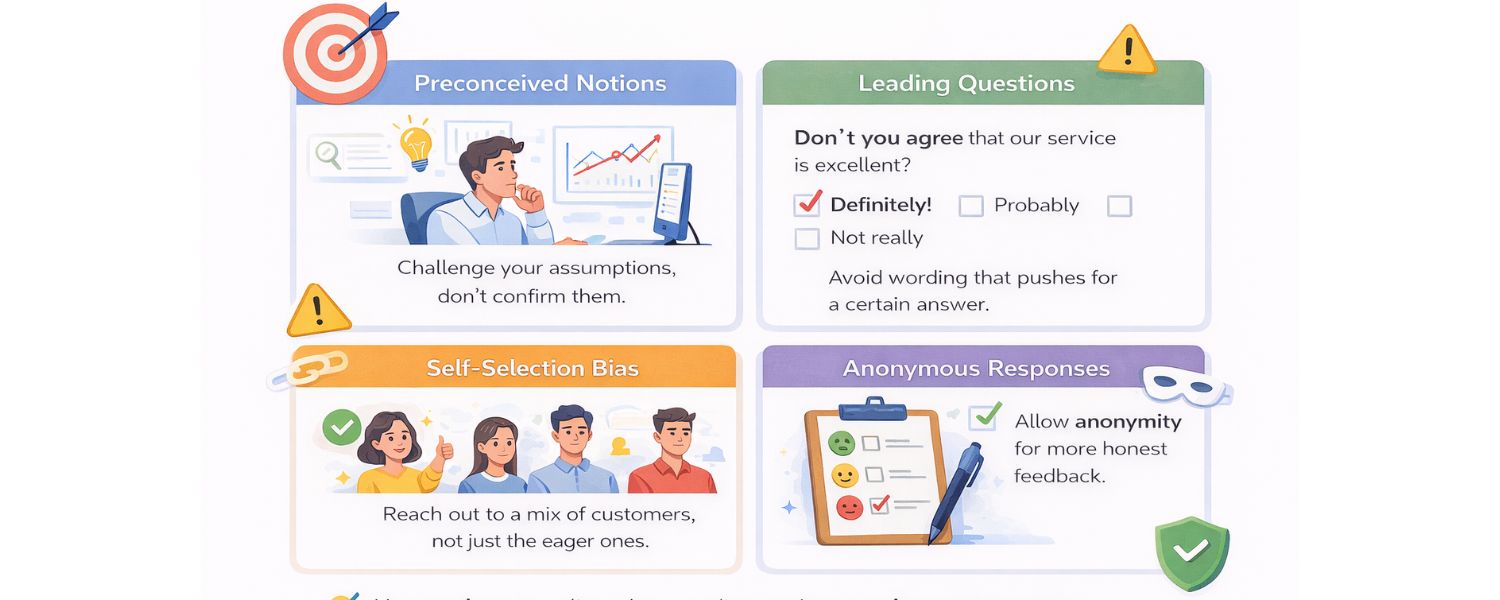

3. Mind Your Biases

Both researchers and respondents can introduce bias. As a researcher, be aware of any preconceived notions and design your study to challenge them, not just confirm them.

With surveys or interviews, avoid leading questions that push people toward a certain answer, and consider anonymity for more honest responses on sensitive topics. Also, watch out for self-selection bias – if only your most enthusiastic customers volunteer for a survey, you might get an overly rosy picture.

To combat this, actively reach out to a mix of customer types (happy, neutral, and unhappy) or use incentives to improve response rates across the board. High data quality requires a bit of scientific rigor: randomize where appropriate, double-check that questions are understood consistently, and clean out clearly bogus responses.

4. Combine Multiple Methods

As discussed, a holistic approach yields the best insights. Triangulate your data by using multiple research methods. For example, use a survey to quantify general trends, interviews to explore the reasons behind those trends, and analytics to observe actual behavior aligning with what you heard.

If all methods point to the same insight, you can be confident in it. If they conflict, dig deeper – maybe different segments behave differently, or there’s an unmet need hiding in the discrepancy. Multiple data sources will give you a more rounded, reliable view of your audience. Don’t rely on just one method or one data point.

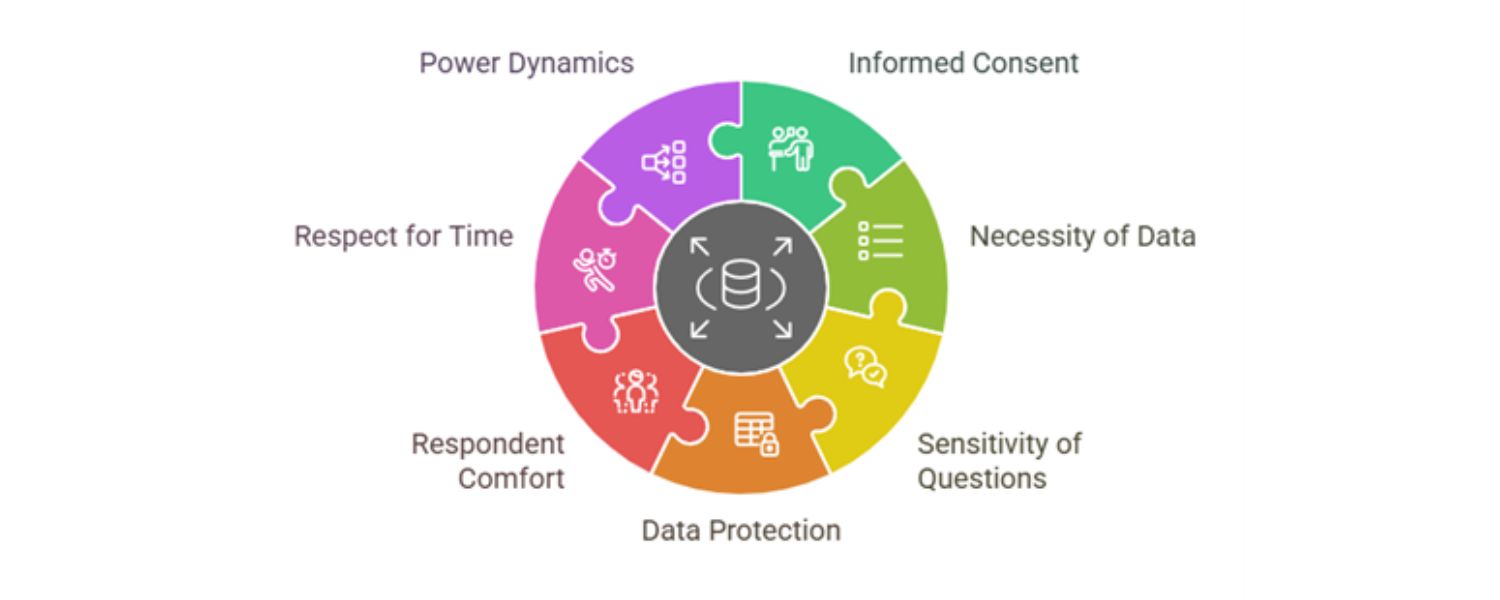

5. Keep It Ethical and Transparent

When conducting research, especially direct outreach like surveys and interviews, be transparent with participants. Let them know the purpose of the research, respect privacy laws (like GDPR) when dealing with personal data, and always express appreciation for their time.

A small token of thanks or incentive can boost participation and goodwill. Also, share findings with relevant colleagues and even with participants if appropriate – closing the feedback loop shows you truly value their input. Ethical research practices build trust, which is important if you’ll be engaging the same audience again in the future.

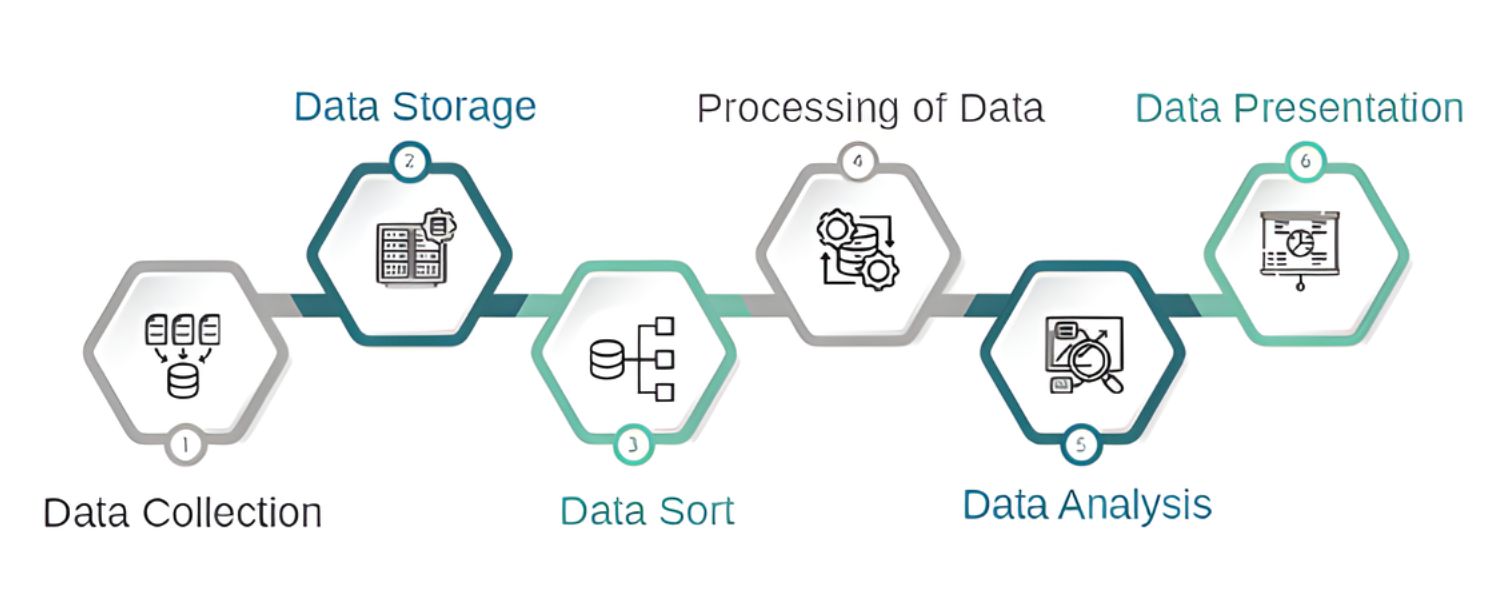

6. Analyze and Apply the Insights

Research isn’t over when the surveys are filled out – arguably the most important phase is analysis. Take the time to comb through the data for patterns: What key themes emerged in interviews? What differences appear when you compare responses by segment (e.g., by age group or customer vs. non-customer)?

Use data visualization if it helps to make sense of survey results or to communicate findings to your team. The end goal is to translate raw data into clear insights and recommendations.

For example, you might conclude “Audience segment A is very interested in eco-friendly practices, which we aren’t highlighting – we should incorporate that into our messaging.” Ensure every insight ties back to how you can improve your marketing, product, or strategy.

Ultimately, audience research insights should inform action – whether it’s tweaking your value proposition, targeting a new channel, or developing content that addresses a newly discovered customer question.

Conclusion: Turn Insights into Action

In today’s fast-paced, customer-centric landscape, audience research is not a luxury – it’s a necessity. It provides the evidence behind your marketing strategy, ensuring you invest in the right messages, channels, and products.

By systematically gathering data on who your audience is, what they care about, and how they behave, you gain a roadmap for how to reach them in a meaningful way. You’re no longer making wild guesses or relying on gut feeling alone; you’re making informed choices that can save time, budget, and ultimately win more business.

Remember that audience research is ongoing. Audiences evolve – new trends emerge, needs shift, and your business might attract different groups over time. Building a habit of continual research (even if it’s light touch, like periodic surveys or regular social listening) will keep you in tune with those changes so you can adapt.

As one marketer noted, many companies are surprised when proper research reveals their real audience is different from who they thought it was, or that their messaging was off-target. Regular research ensures you stay aligned with reality, not assumptions.

Now it’s your turn. Take a look at your current understanding of your audience – and commit to deepening it. Start with a clear goal, choose a couple of methods that fit your needs, and dive in.

Whether you schedule a few customer calls, send out a survey, or analyze a month’s worth of social media chatter, any step toward learning more about your audience is a step toward more impactful marketing.

The payoff can be huge: campaigns that click with customers, products that truly solve their problems, and a brand experience that builds loyalty because it feels tailored to them.

In short, knowing your audience is the foundation of marketing success. So, don’t market in the dark. Illuminate your strategy with real audience insights – and watch the difference it makes in your results. Start your audience research today and unlock the power of truly understanding the people who matter most to your business.

.png)

.png)

.png)

.png)

.png)

.png)