Outshine Your Competition with Competitive Benchmarking

August 12, 2025

Introduction

In today’s hyper-competitive business landscape, competitive benchmarking is a crucial strategy for staying ahead.

This practice involves comparing your company’s performance metrics against industry peers to gauge where you stand and how to improve. By analyzing what top competitors are doing – from their sales figures to customer satisfaction scores, businesses can identify gaps, learn from the best, and strategize effectively.

For example, consider the global smartphone rivalry: as of Q2 2022, Apple held 18.8% of the market share compared to Samsung’s 21.6%. Such benchmarking data not only highlights who is leading but also spurs companies to refine their products and marketing strategies.

In this comprehensive guide, we’ll explain what competitive benchmarking is, why it’s important, the different types and metrics involved, and a step-by-step approach to implement benchmarking in your organization.

By the end, you’ll have the insights and tools to measure yourself against “the best” and leverage those insights into actionable improvements. Let’s dive in!

What Is Competitive Benchmarking?

Competitive benchmarking is the process of measuring your business’s performance by comparing specific metrics to those of your competitors.

In simple terms, it’s about evaluating how you stack up against others in your industry on key performance indicators (KPIs) like market share, revenue, customer satisfaction, and more.

The goal is to understand your relative strengths and weaknesses so you can improve and close the gap with leading competitors.

It’s worth noting that the concept of “benchmarking” originally comes from land surveying, meaning a fixed reference point, and was popularized in business by companies like Xerox in the 1980s.

Today, competitive benchmarking has evolved into a data-driven exercise where businesses use both public data and industry research to gauge their success against external benchmarks (competitors or industry standards).

Competitive Benchmarking vs. Competitive Analysis

It’s easy to confuse competitive benchmarking with mastering competitive analysis, but they serve different purposes. A competitive analysis (or competitor analysis) is a broad, qualitative study of competitors’ overall strategies, products, marketing, strengths, and weaknesses.

Think of it as examining a rival under a microscope, you gather as many insights as possible to understand their entire business strategy. The aim is often to find strategic opportunities or gaps in the market.

Competitive benchmarking, on the other hand, is more narrowly focused on measurable metrics and direct comparisons. It’s like placing a GPS tracker on a moving target – you continuously monitor specific performance indicators over time.

Instead of a holistic deep dive into everything a competitor does, benchmarking asks: “On key metrics that matter to us, where do we rank?” For instance, you might benchmark your website traffic, conversion rates, social media following, or customer service ratings against competitors’ numbers. The goal isn’t to capture every detail of their strategy, but to quantitatively measure how you stack up on crucial KPIs.

In summary, competitive analysis informs why competitors succeed, while competitive benchmarking shows how much better (or worse) you are in specific areas. Both are valuable, analysis gives context and ideas, and benchmarking provides hard performance targets.

Why Is Competitive Benchmarking Important? (Key Benefits)

In a world where standing still means falling behind, competitive benchmarking provides several important benefits for your business:

1. Objective Performance Evaluation

Benchmarking gives an objective view of where your business stands in the market. Without it, you only have an internal perspective and might overestimate your performance.

Comparing against external yardsticks lets you see the reality, perhaps your 5% growth is good, but if the industry grew 10%, you’re lagging. This context is invaluable for honest assessments.

2. Identify Strengths and Weaknesses

By measuring specific metrics against competitors, you quickly spot weak areas needing improvement. For example, you may discover your customer support response time is twice as slow as the industry leader’s, flagging a critical gap to fix.

Conversely, you might find areas where you outperform rivals, which you can then tout as competitive advantages. Benchmarking essentially acts as a gap analysis tool, revealing where competitors are doing better and where you can improve.

3. Informed Goal Setting and Strategy

Understanding how you compare helps in setting concrete, data-driven goals. Instead of arbitrary targets, you can aim to match or beat the benchmark set by a top competitor.

If the industry best has 15% market share and you’re at 10%, that gap becomes a goal to close. Benchmark data provides motivation and specificity – e.g., “increase our social media followers to 50k to surpass Competitor X.”

It also informs strategy: knowing what’s working for others guides where to focus your efforts.

4. Better Decision Making

Decisions backed by benchmarking data are more likely to succeed. When you know the facts, say, which company leads in customer satisfaction or which digital marketing channel drives most traffic, you can make strategic choices grounded in evidence.

Benchmarking removes guesswork; it provides the market context to justify investments (for instance, investing in SEO because competitors get more organic traffic than you do).

5. Track Progress Over Time

Benchmarking isn’t a one-time exercise, it’s most powerful when done regularly. By continuously benchmarking, you can track your progress and see if changes you implement are closing the gap.

This ongoing tracking creates a feedback loop for continuous improvement. It also alerts you to shifts in the competitive landscape: if a competitor leaps ahead in a metric, you’ll catch it early and can respond faster.

6. Drive Innovation and Adaptability

Importantly, competitive benchmarking helps you stay on top of emerging trends and innovations.

By watching what competitors do well, you get inspired with new ideas for your own business. Maybe a rival launches a popular new feature or adopts a cutting-edge technology, their success can signal an opportunity for you to innovate.

In this way, benchmarking fosters a culture of outward-looking learning rather than complacency. It pushes teams to ask, “What can we do better to outshine the rest?” and encourages agility in adapting to market changes.

Ultimately, this can mean the difference between staying relevant or becoming obsolete in a fast-paced market.

7. Motivation and Accountability

Knowing where you stand can be highly motivating for your team. Publicly available benchmarks or industry rankings create a sense of urgency and competition. If your company is third in market share, that’s a tangible position everyone can rally to improve.

Benchmarking results can be used as a motivational tool to drive performance, sales teams strive to beat the top competitor’s revenue, or customer service aims to have the highest satisfaction score in the sector. It turns abstract goals into a competitive game that energizes teams to excel.

In short, competitive benchmarking is crucial because it provides critical context and direction for improvement. It’s not about copying competitors for the sake of it, but about learning where you can do better and using that intelligence to fuel your growth.

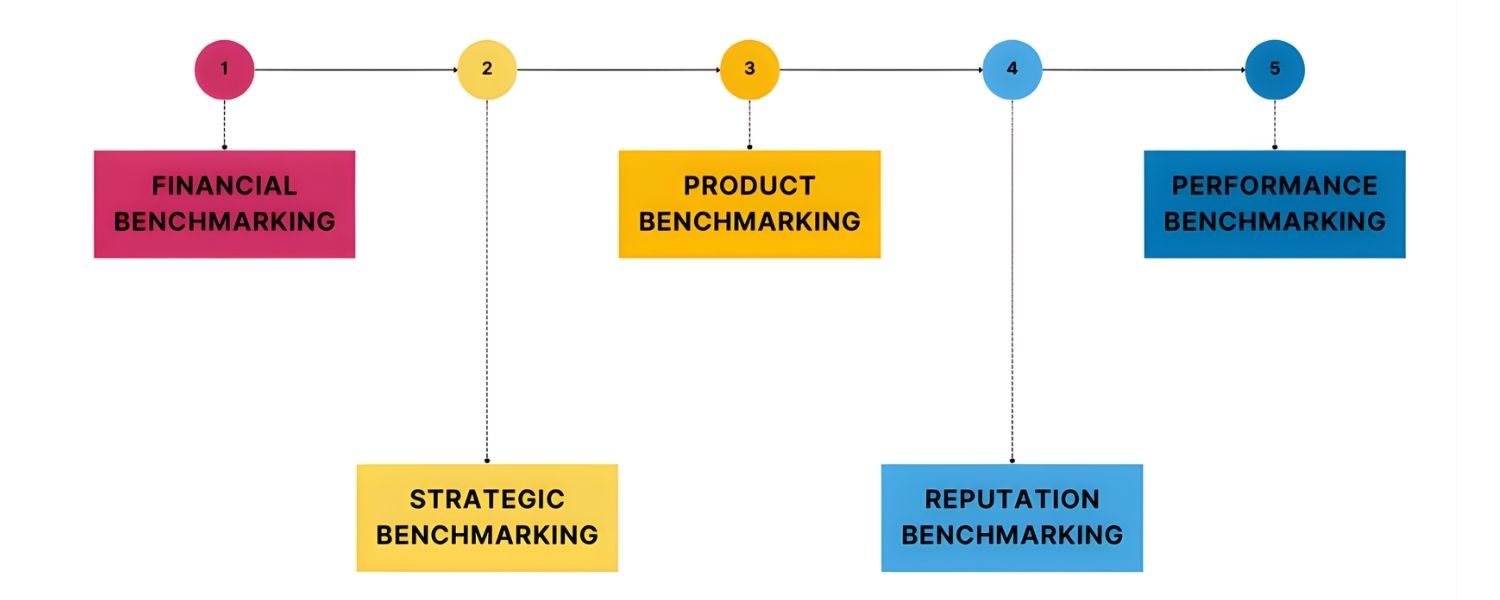

Types of Competitive Benchmarking

Competitive benchmarking isn’t one-size-fits-all. Depending on your goals, you can benchmark different aspects of your business. Here are the main types (or focus areas) of competitive benchmarking and what they entail:

1. Performance Benchmarking

This involves comparing outcome metrics and key performance results across companies. You look at what results competitors are getting.

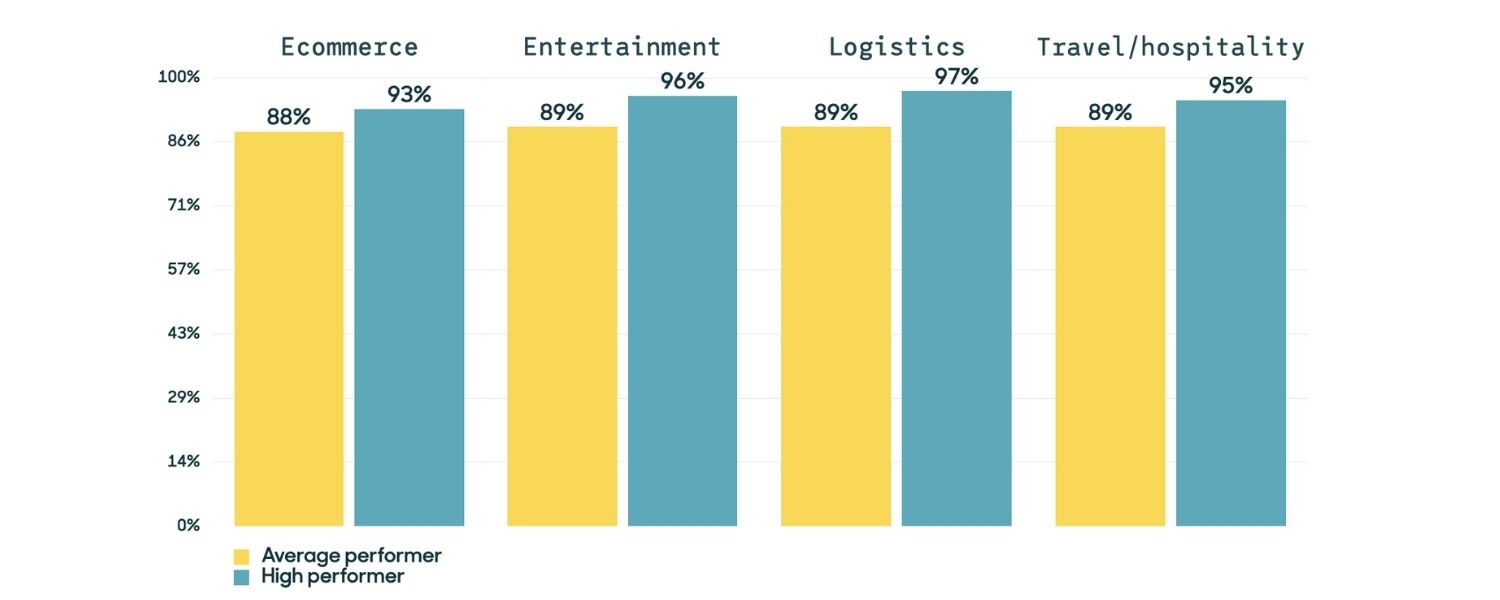

Common performance benchmarks include financial metrics (revenue, profit margin, growth rate), market metrics (market share, customer acquisition rate), and marketing outcomes (website traffic, conversion rates, search engine rankings).

For example, benchmarking sales figures or ROI against industry leaders would fall under performance benchmarking. The question answered is: “How do our results compare to others?”

2. Process Benchmarking

This type focuses on how things are done, the business processes and operations behind the results. Here, you compare specific processes or workflows to find efficiency or quality differences.

For instance, you might benchmark your manufacturing process, customer service response process, or marketing campaign process against a competitor’s process. The goal is to identify best practices that lead to better performance.

By understanding how competitors achieve superior outcomes, you can optimize your own processes accordingly. For example, if a rival fulfills customer orders 20% faster, you’d study their logistics process in detail.

3. Strategic Benchmarking

This looks at the big-picture strategies and business models of your competitors. Companies use strategic benchmarking to compare how others approach the market and find ideas to strengthen their own strategy.

This could involve analyzing competitors’ positioning, pricing strategy, product mix, or customer engagement strategies at a high level. The point is to learn what strategic decisions make certain companies successful and consider how to emulate or improve upon those approaches.

For example, a small e-commerce retailer might benchmark the omnichannel strategy of Amazon to inform its own long-term strategy.

4. Financial Benchmarking

A subset of performance benchmarking, financial benchmarking zeroes in on fiscal performance indicators. It compares metrics like total revenue, profit margins, cost of goods sold, debt ratios, or return on assets among competitors.

This helps a business understand its financial health relative to peers – e.g., if your profit margin is 10% but competitors average 15%, you may have cost issues to address. Financial benchmarking is especially useful for identifying operational inefficiencies and setting financial targets.

5. Product Benchmarking

This involves comparing the quality, features, and success of your products or services against those of competitors.

Companies perform product benchmarking to evaluate how their offerings stack up in terms of customer value. Metrics might include defect rates, feature set comparisons, customer reviews, warranty claims, or price point versus features.

By benchmarking products, you can discover if a competitor’s product is outperforming yours and why, perhaps they have a superior feature or better pricing strategy – and then work on improving your own product accordingly.

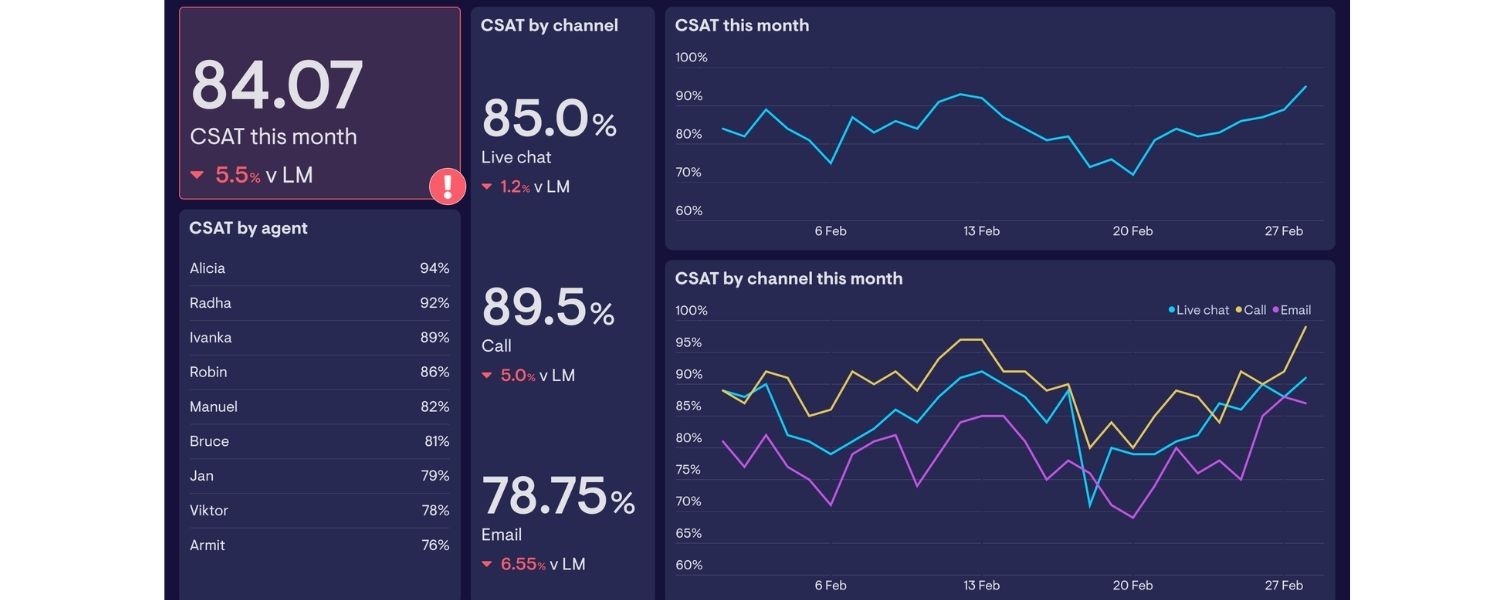

6. Customer Experience or Reputation Benchmarking

Here, the focus is on how your brand is perceived and the experience it delivers compared to others. Metrics include customer satisfaction scores, Net Promoter Score (NPS), online ratings/reviews, social media engagement, and share of voice in the market.

For instance, you might benchmark customer satisfaction survey results or social media sentiment against a competitor. If you find your NPS is significantly lower than a rival’s, it signals you need to dig into customer feedback and make changes.

Reputation benchmarking is increasingly important in the age of online reviews, a company that consistently benchmarks as having the best customer satisfaction in its class can leverage that as a selling point.

Keep in mind that internal vs. external benchmarking are also two broad categories often discussed. Internal benchmarking means comparing metrics within your own organization (e.g., between departments or time periods), while external (competitive) benchmarking, the focus of this article, means comparing against other companies.

Internal benchmarking helps in tracking your own improvement, but it’s the external competitive benchmarks that reveal your standing in the market.

Most benchmarking initiatives will involve elements of multiple types above. For example, a comprehensive competitive benchmarking study might include financial metrics (financial benchmarking), process efficiency metrics (process benchmarking), and customer satisfaction metrics (reputation benchmarking) to give a well-rounded view.

Choose the type(s) that align best with your strategic goals. If unsure, performance and process metrics are a great place to start, as they show what results and how those results are achieved, respectively.

Key Metrics and Areas to Benchmark

When beginning a competitive benchmarking effort, it’s important to select the right metrics. Virtually anything quantifiable can be benchmarked, but here are some popular metrics/categories that companies commonly examine:

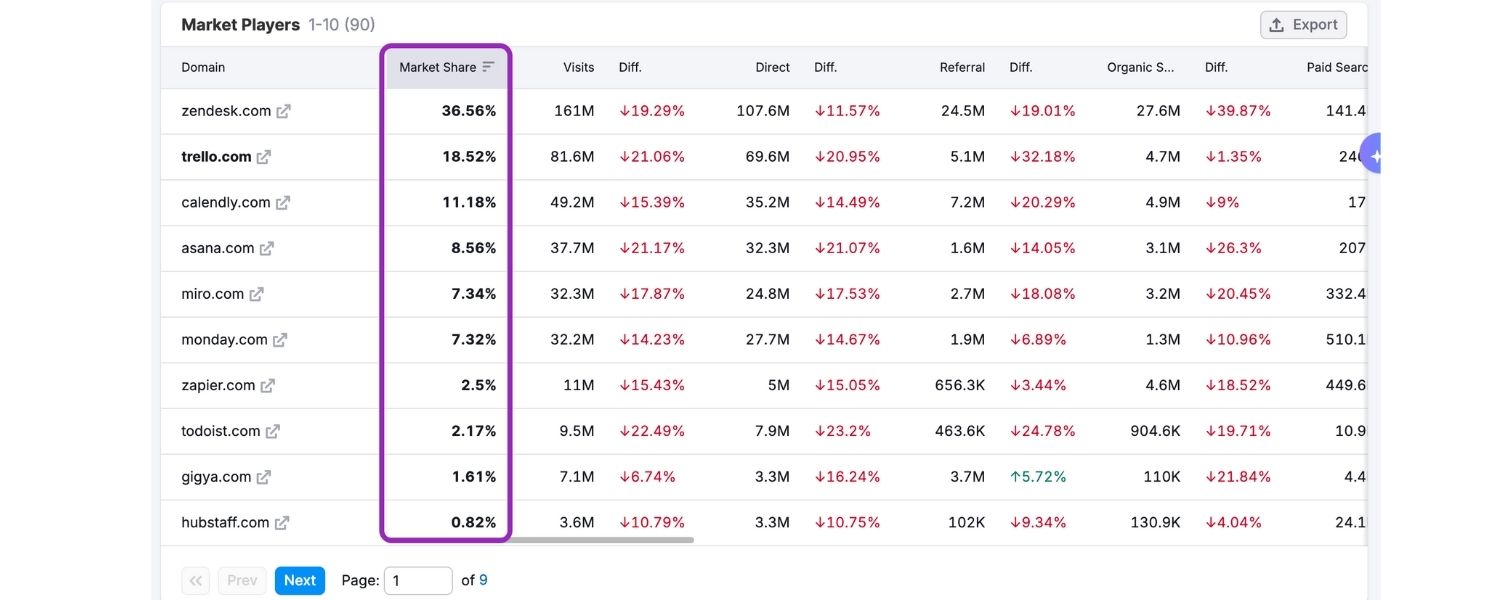

1. Market Share

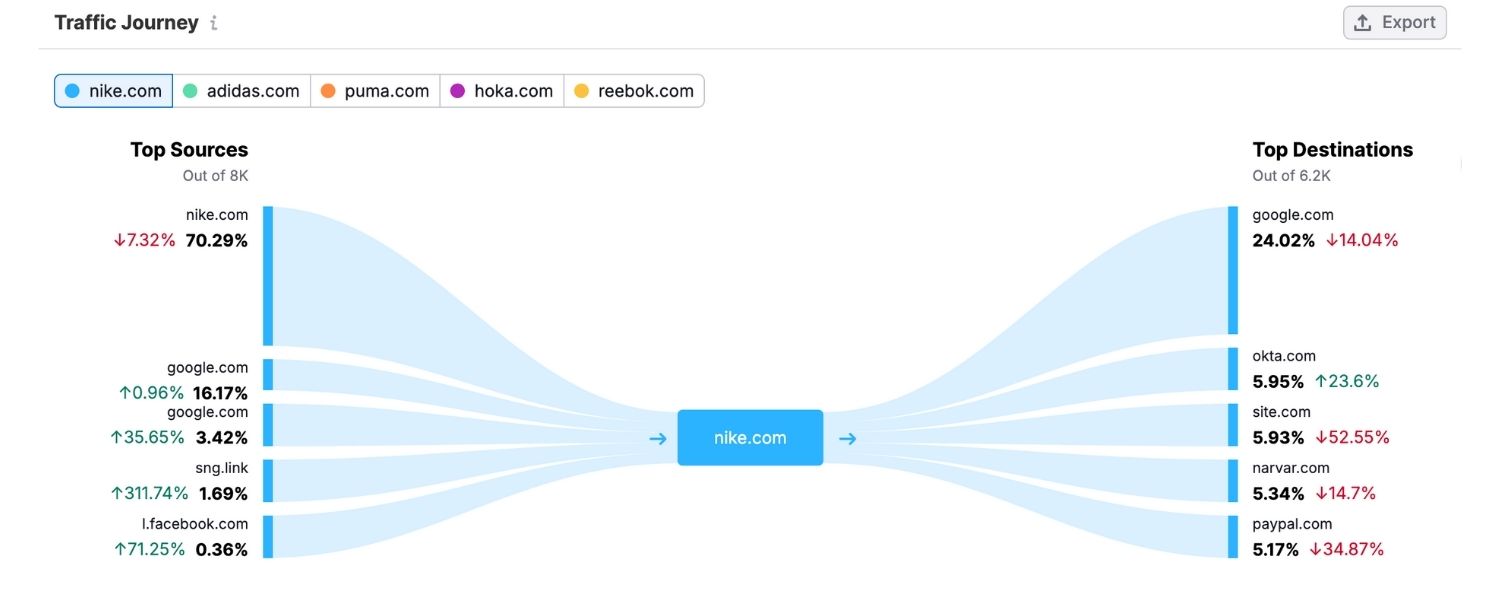

The percentage of the market (in terms of revenue, customers, or web traffic) that your company holds versus competitors.

Market share is a telling indicator of overall competitiveness. For instance, tracking your website traffic market share shows how your online presence compares in your industry.

If Competitor A has 30% of total industry web visits and you have 10%, you have significant room to grow. Market share trends over time also reveal whether you’re gaining or losing ground.

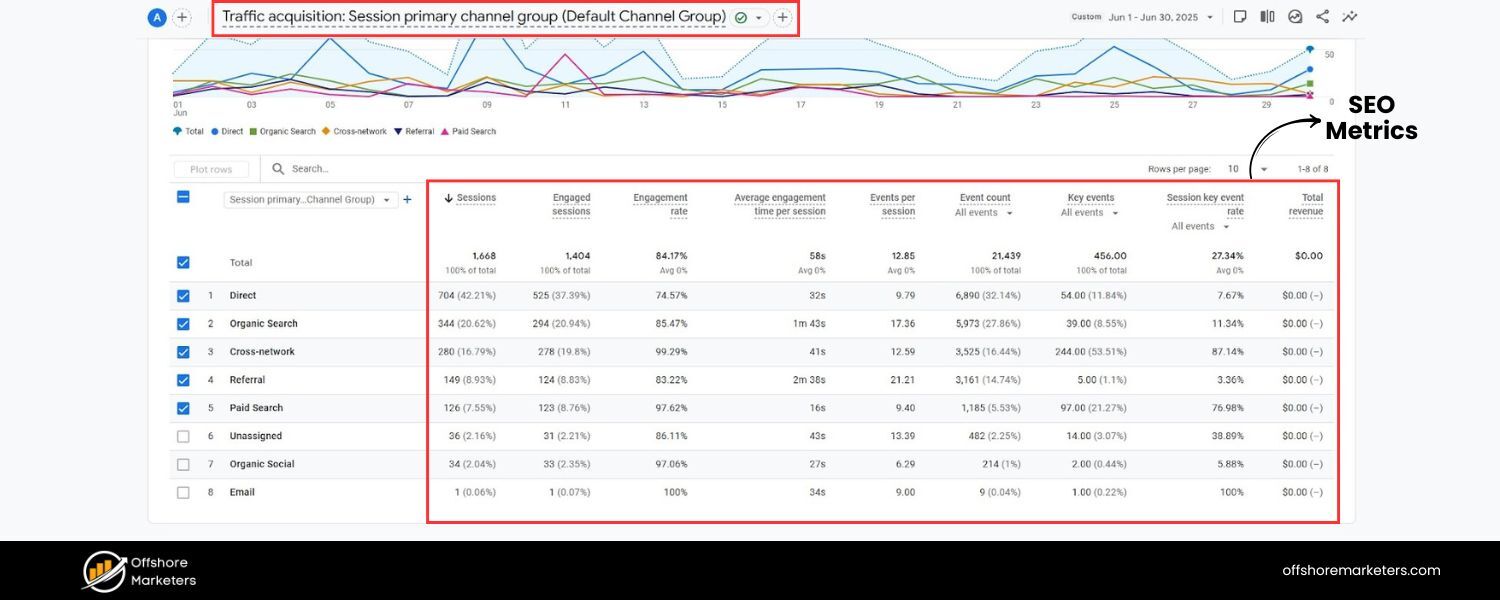

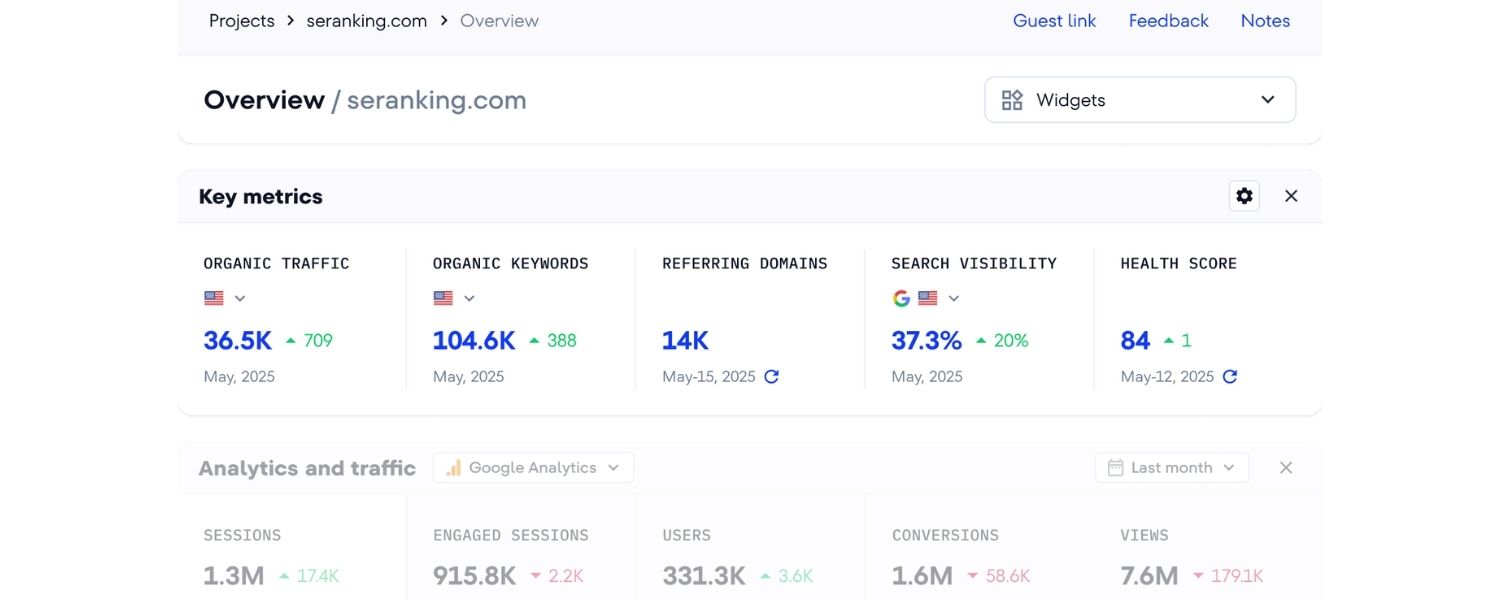

2. Website Traffic & SEO Metrics

Comparing website performance is crucial in the digital era. Metrics like total website visits, traffic by source (organic, paid, social, referral), bounce rate, and domain authority can be benchmarked.

Also, keyword rankings are key, how your search engine rankings for important keywords compare to competitors. If rivals consistently rank above you on Google for high-value search terms, it highlights an SEO opportunity.

Tools can provide competitive keyword gap analysis to see where others are outranking you.

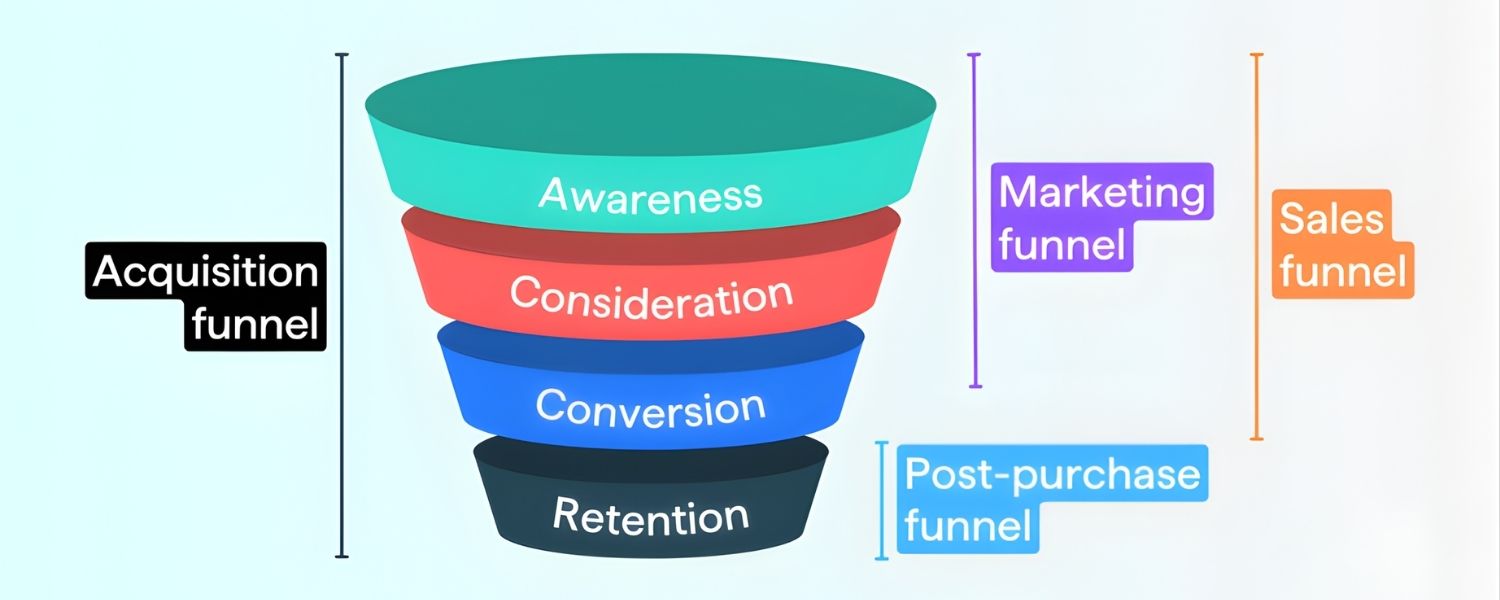

3. Customer Acquisition & Sales Funnel

Metrics such as conversion rates, lead generation rates, cost per acquisition, and sales conversion percentages can be benchmarked if data is available or can be estimated.

For example, if your free trial conversion rate is 5% and a competitor reports 10%, there may be best practices in their sales funnel you can learn from. Public metrics like quarterly sales growth or number of new customers (if disclosed) can serve as proxies for this area.

4. Customer Satisfaction & Loyalty

As mentioned, customer-centric measures like CSAT (customer satisfaction score), NPS, online review ratings, and customer retention/churn rates are extremely valuable benchmarks.

They tell you how well you are serving customers relative to others. For instance, benchmarking an average Yelp or Trustpilot rating against competitors can uncover if you have a service quality issue. High customer loyalty (e.g., repeat purchase rates) compared to peers could be a competitive advantage to highlight.

5. Product Quality & Innovation

Metrics here could include product return rates, defect rates, time between new product releases, or number of new features introduced per year. If a competitor is rolling out new features faster or has fewer quality complaints, those are areas to investigate.

Awards or industry ratings can also be considered (e.g., product of the year awards, etc., as a qualitative benchmark of product excellence).

6. Operational Efficiency

Benchmark internal efficiency metrics where possible, for example, average delivery time, customer service response time, or production cost per unit. If available, compare against industry averages or specific competitors.

Operational benchmarks often tie directly to cost leadership; a company with a significantly lower cost per unit (due to efficiency or scale) will have a profit edge.

Even without exact competitor data, industry benchmarks (from studies or associations) on metrics like manufacturing cycle time or support ticket resolution time are useful reference points.

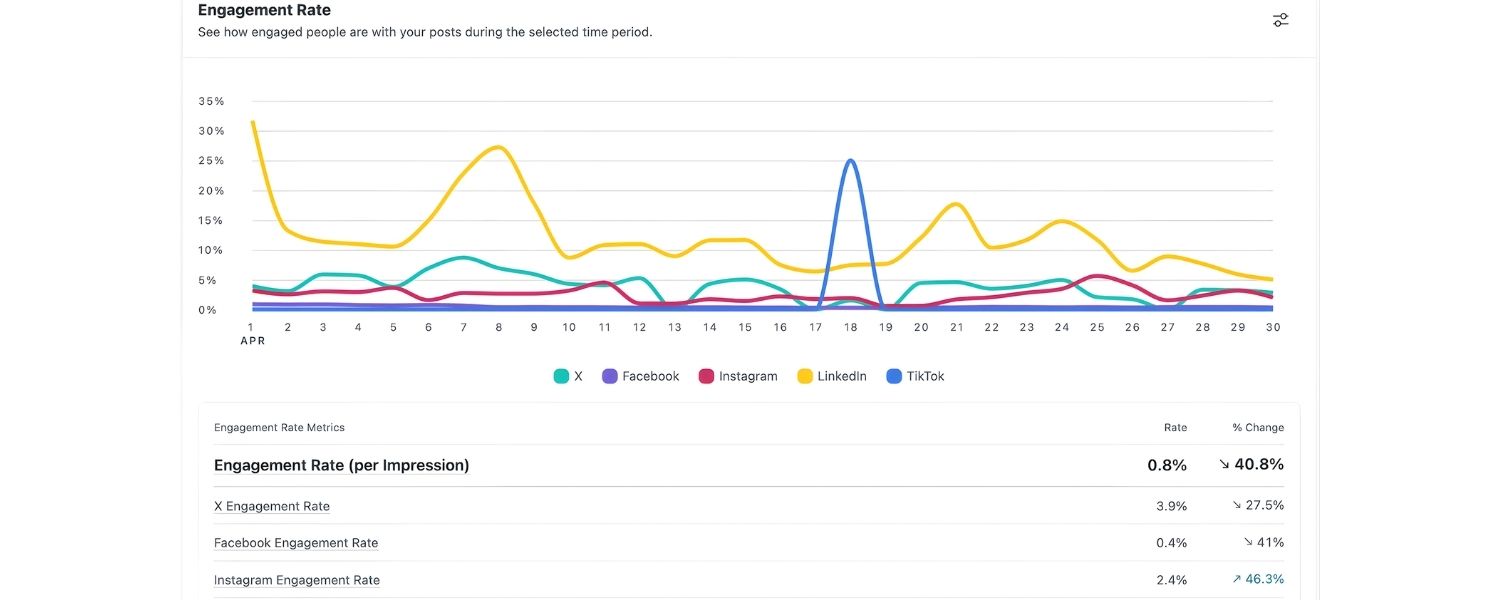

7. Marketing & Social Media

Compare digital presence metrics such as number of social media followers, engagement rates, content output (blogs per month, etc.), and email open or click rates if known.

A higher social following or engagement suggests stronger brand awareness and community. Also consider benchmarking share of voice in media or online mentions, e.g., what percentage of industry news mentions or social mentions does your brand get versus competitors.

A higher share of voice indicates your brand is leading the conversation in the space.

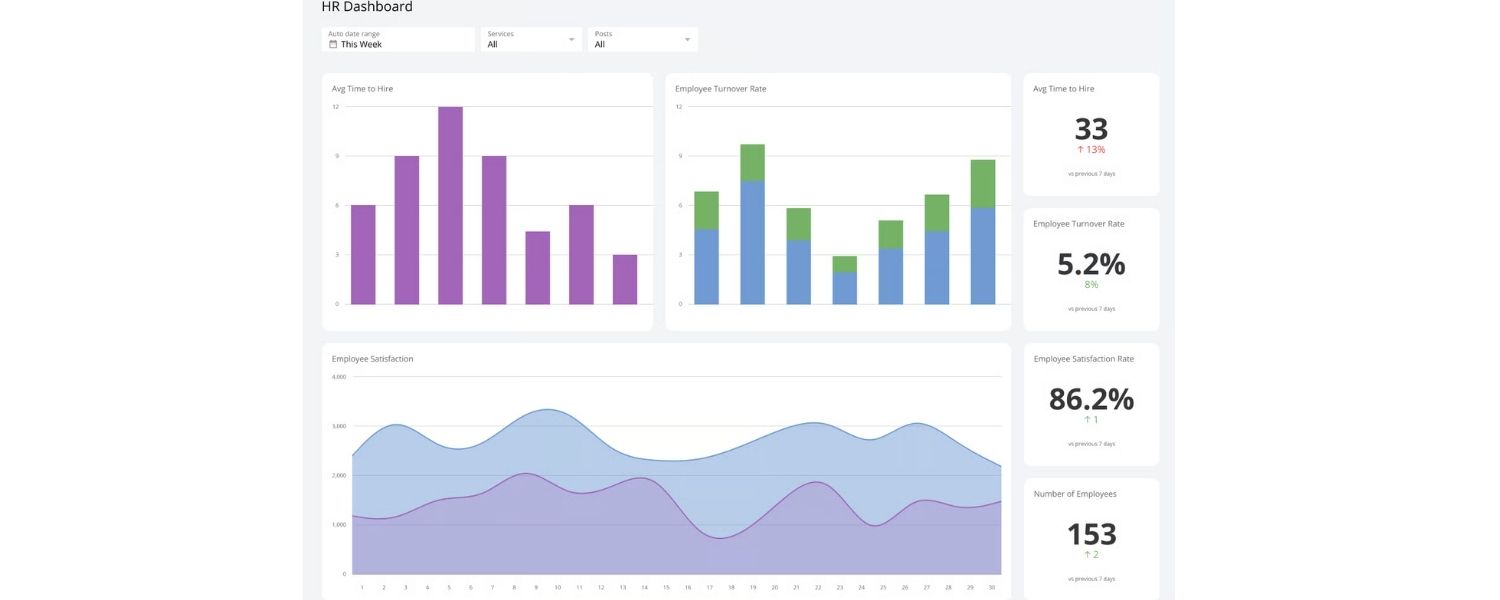

8. Human Resources Metrics

Sometimes, even internal HR metrics like employee turnover, employee satisfaction (via surveys), or headcount growth can be benchmarked externally, especially if you have access to industry reports.

A much higher turnover than industry average could signal cultural or management issues that put you at a competitive disadvantage in talent retention. Some companies even benchmark diversity and inclusion metrics against industry leaders as part of their social responsibility goals.

Tip

When selecting metrics, focus on those tied to your strategic objectives. If customer experience is your differentiator, benchmark customer-centric metrics. If operational excellence is your game, benchmark cost and process efficiency metrics.

And ensure the data for chosen metrics is accessible, some data (like web traffic, SEO, social media stats) are readily available via tools, while others (like profit margins or internal process metrics) might be harder to obtain from competitors.

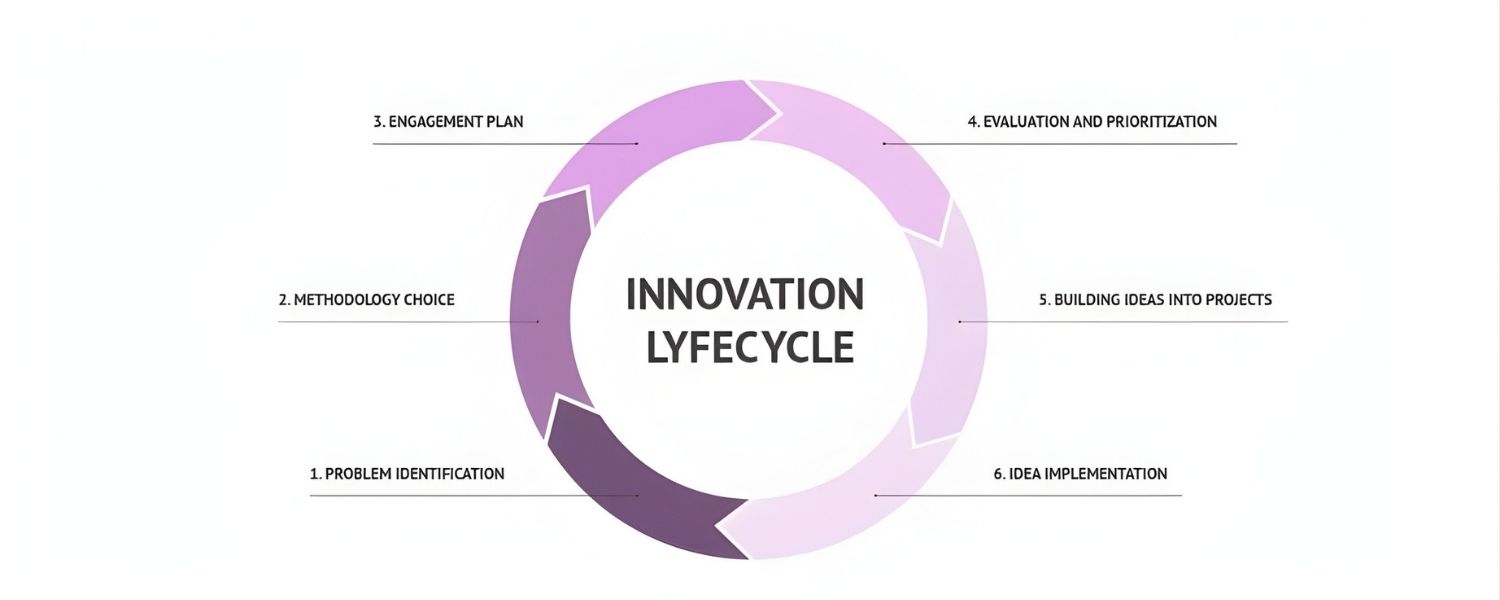

How to Conduct a Competitive Benchmarking Analysis (Step-by-Step)

Ready to start benchmarking? Below is a step-by-step approach to effectively benchmark your company against the competition. Following these steps will help ensure your benchmarking process is structured and yields actionable insights:

1. Define Your Goals and What to Benchmark

Start by clearly defining the objectives of your benchmarking initiative. What do you want to achieve or learn? Identifying the focus will guide all other steps.

For example, your goal might be “Improve customer satisfaction score by 10 points” or “Increase market share in online sales.” Based on your goals, decide which KPIs or metrics to benchmark.

These should be the metrics most relevant to your success, if your goal is customer satisfaction, benchmark CSAT and NPS; if it’s market share, benchmark sales figures, traffic share, etc.

It’s best to limit to a manageable set of key metrics initially (a handful that matter most), rather than overwhelming yourself with too many data points. Make sure each chosen metric ties back to a performance area you truly care about.

As marketing experts advise, identifying the right KPIs upfront ensures your benchmarking effort stays focused and meaningful.

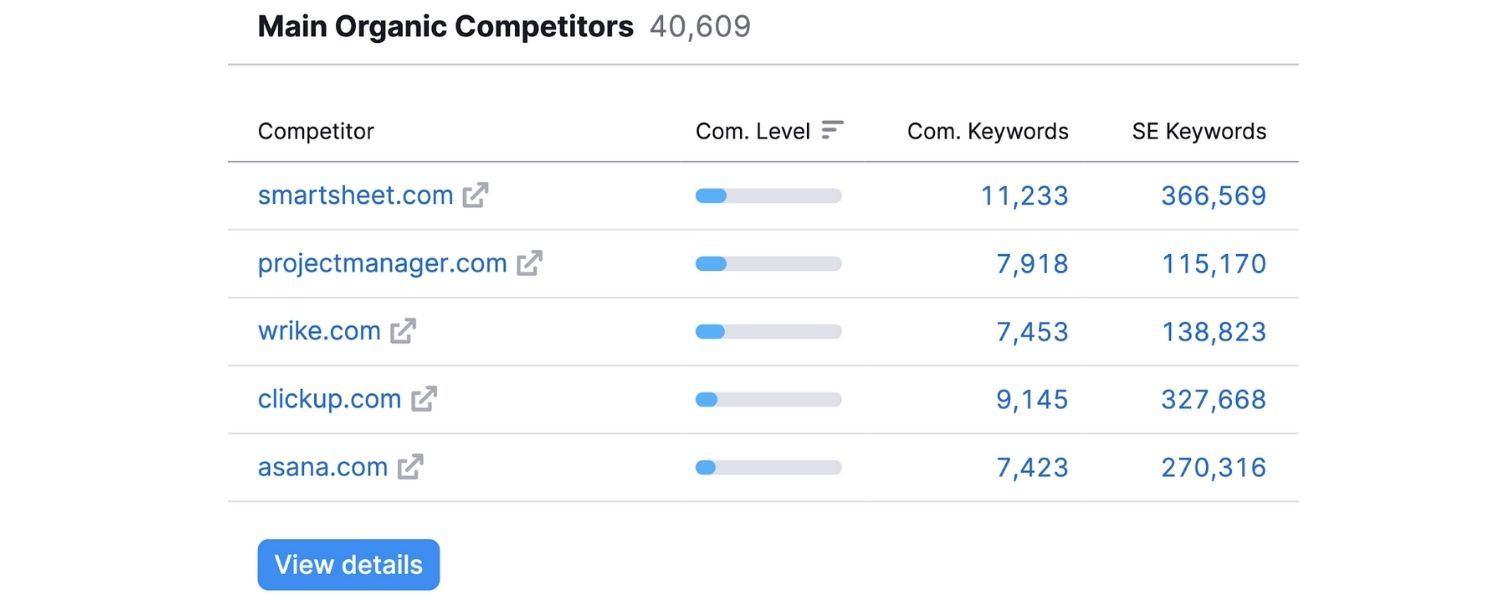

2. Identify Your Competitors to Benchmark Against

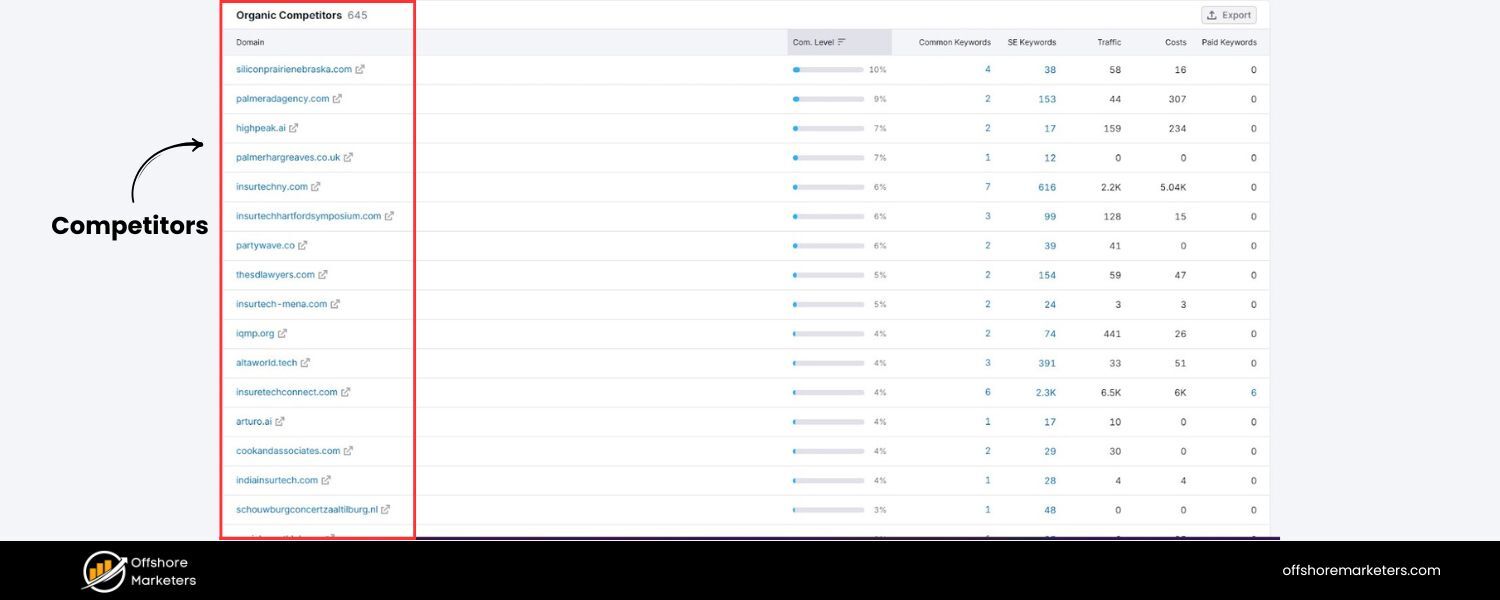

Next, decide who you will compare yourself against. Create a list of competitors that are relevant benchmarks for your goals. Typically, you want to include 3-5 direct competitors that offer similar products or services and target the same market segment.

These direct rivals provide the most apples-to-apples comparison. However, also consider including industry leaders, even if they’re much larger or a different segment, to see what “the best in class” looks like. For instance, a startup might benchmark certain metrics against a big industry leader to set aspirational targets.

You can also benchmark against smaller emerging competitors (potential disruptors) to catch early trends. And sometimes, benchmarking a similar process in another industry can yield innovative ideas (this is known as functional benchmarking).

Start with your primary, current competitors, but be strategic – choose competitors that will provide insight and push you to improve, not just those easy to beat. If you’re not sure who your top competitors are, tools like market research platforms or SEO competitive analysis tools can help surface the main players in your domain.

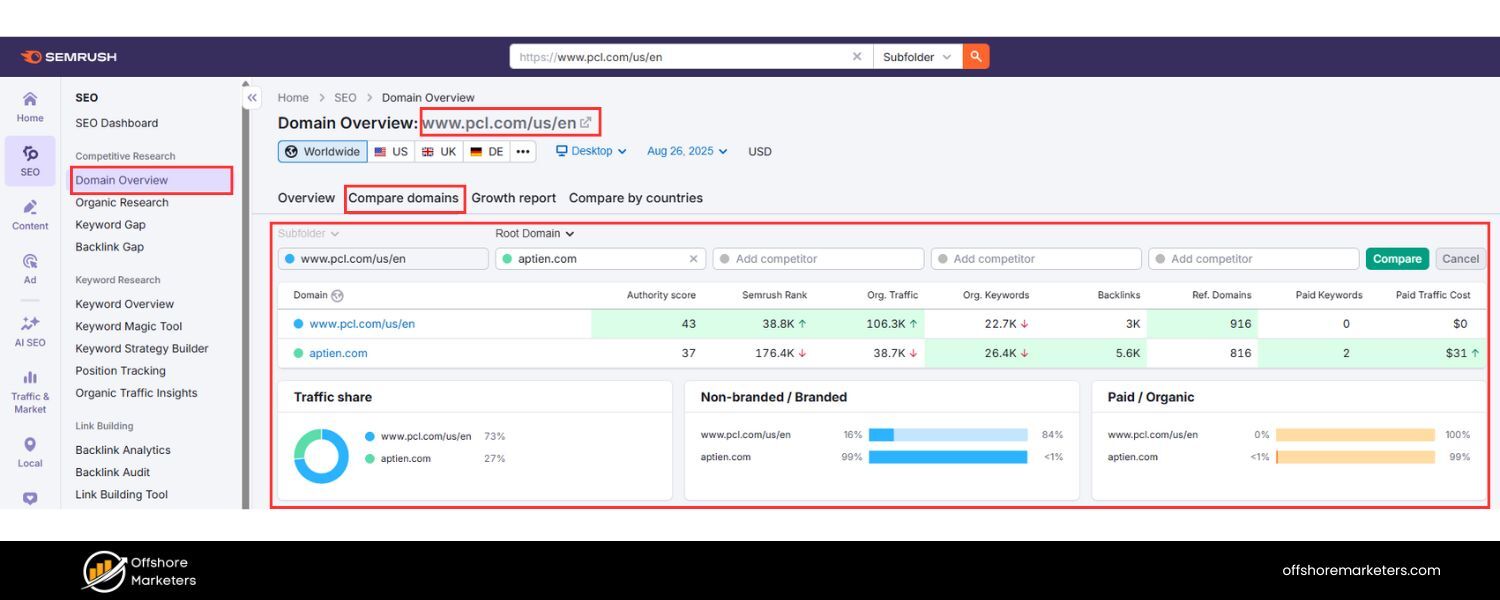

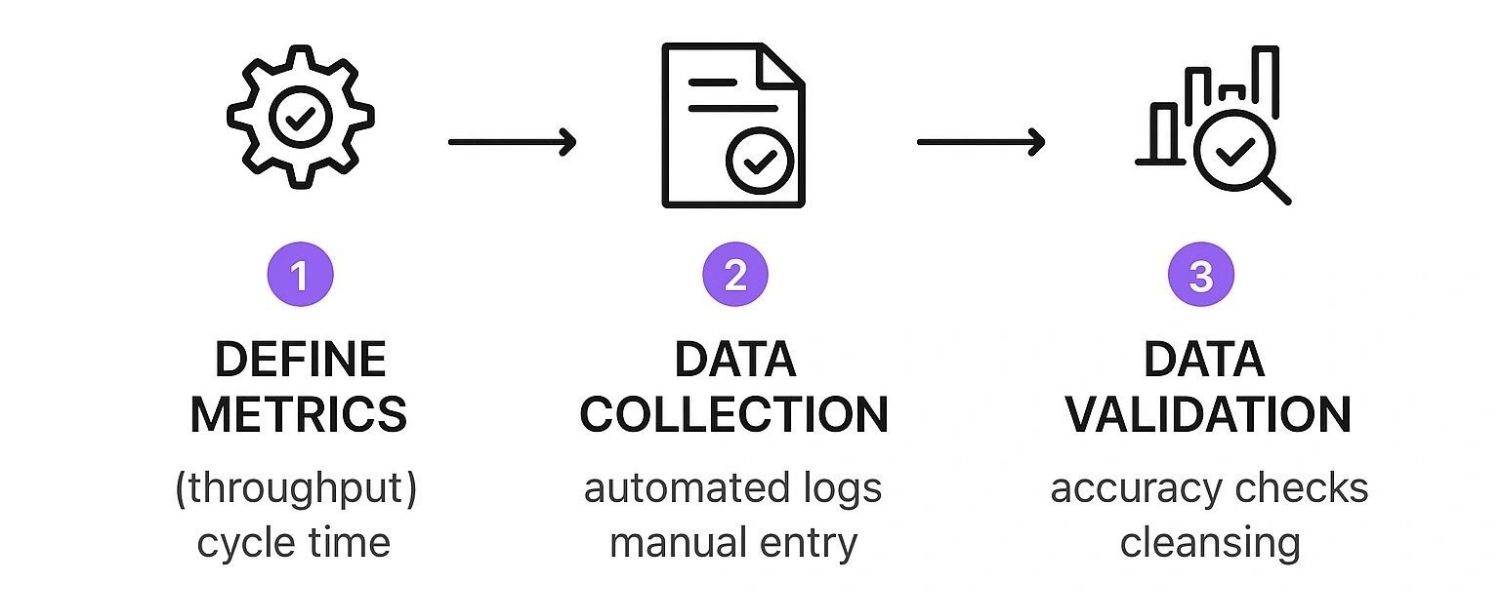

3. Collect Data on Chosen Metrics

With your metrics and competitor list in hand, it’s time to gather the data. This step can be the most labor-intensive, but it’s where you turn anecdotal hunches into hard numbers.

Start with internal data, collect your own company’s figures for each metric (from analytics, financial reports, customer surveys, etc.) so you know your baseline. Then, collect competitor data.

Some data will be publicly available (annual reports for financials, website traffic via tools like Semrush or SimilarWeb, social media stats, customer review scores on public sites, etc.). Leverage industry reports and publications for aggregated benchmarks.

For digital metrics, SEO and analytics tools are extremely handy, for example, you can easily find a competitor’s website traffic or keyword rankings using online tools. SEO metrics and web analytics data are often readily accessible via competitive intelligence tools, whereas private data (like internal process efficiency or customer-specific financials) may be tough to get.

Be resourceful, read press releases or case studies where competitors might brag about a metric, use third-party services that estimate metrics (e.g., Glassdoor for employee satisfaction, or analyst reports for market share), and don’t shy away from directly surveying customers about competitors (for qualitative benchmarks).

Also, ensure data is consistent and comparable – define the time period and units for each metric so you compare like with like. If exact figures for competitors are not available, you may use estimates or indexes (e.g., you might not know Competitor X’s exact customer satisfaction score, but if they consistently win industry customer service awards, you know they likely outperform you).

4. Analyze the Data and Identify Gaps

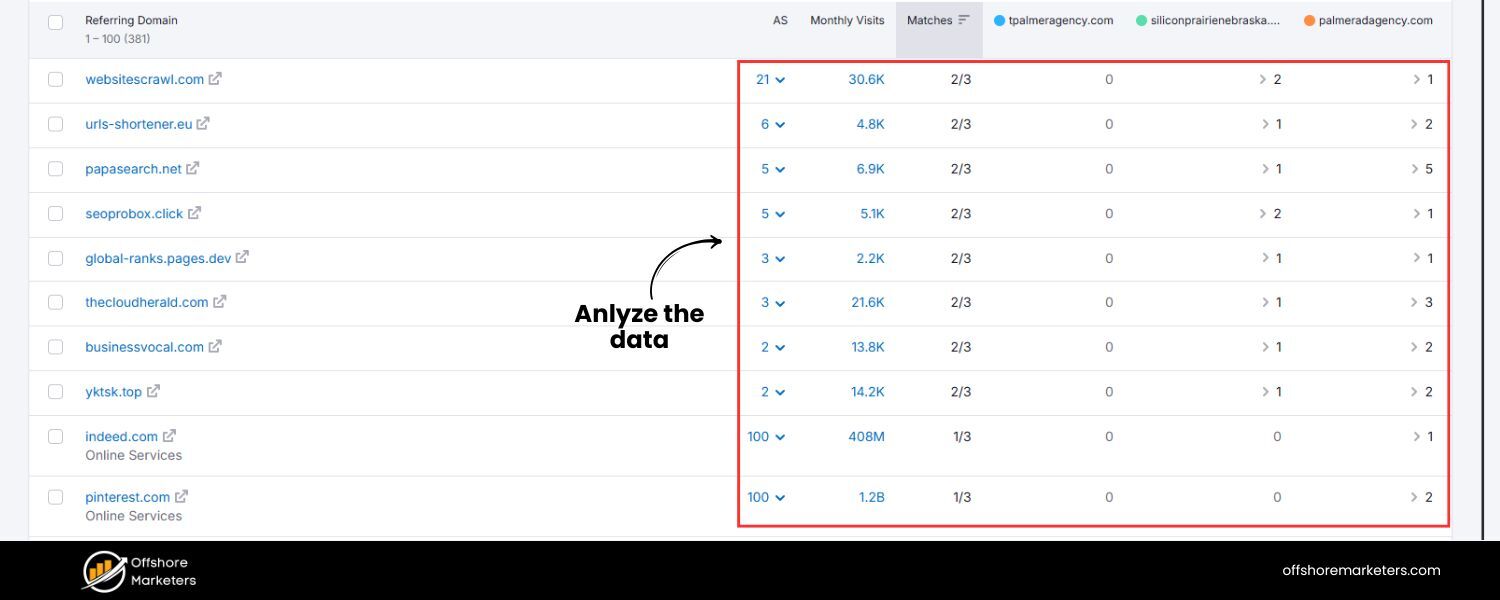

Data by itself doesn’t mean much until you interpret it. Once you have the numbers, analyze them to draw insights. Compare your metric values side-by-side with each competitor.

Determine the performance gap for each metric, how far ahead or behind the benchmark are you? For example: “Our social media followers = 20k, Competitor A = 50k (we have less than half, big gap), Competitor B = 18k (we are slightly ahead).” Look for patterns: maybe you’re consistently lagging in certain areas across all competitors – those are clear weaknesses to prioritize.

Also note if any competitor is a standout leader in a metric; they might be doing something special worth researching further. It helps to visualize the comparisons, perhaps in a table or chart, to easily spot who leads and by how much.

Identify the root causes of gaps where possible, if a competitor’s revenue per employee is higher, is it because of automation, better training, or a different product mix? This may require qualitative analysis or going back to competitive research to hypothesize why the numbers differ.

Additionally, pay attention to trends over time if you have historical data: is the gap closing or widening? Are new entrants quickly catching up? Analyzing trends can indicate if you need immediate action (e.g., a competitor suddenly doubled their web traffic, did they launch a campaign or redesign?).

During analysis, involve stakeholders or team members who know the context behind the numbers; their insight can explain surprising differences. The outcome of this step should be a clear understanding of where you excel, where you underperform, and ideas of what might be driving those outcomes.

5. Turn Insights into an Action Plan

Data is only as useful as the actions it informs. After pinpointing the key gaps and opportunities from your analysis, develop a strategic action plan to improve. Essentially, for each major finding, decide what you will do about it.

For instance, if you discovered your website’s organic traffic lags behind a competitor, your action might be “invest in SEO content and link-building to improve search rankings.” If customer service satisfaction is lower than others, your plan could include additional training for support staff or implementing a new helpdesk system.

Set specific improvement targets tied to the benchmark (e.g., “increase NPS from 30 to 40 to match Competitor B within one year”). It can help to borrow ideas from the top performers: what are they doing that you’re not? If a competitor’s marketing strategy yields better brand awareness, consider adopting some of their tactics with your own twist.

Prioritize initiatives based on impact and feasibility – you can’t fix everything at once, so focus on changes that will move the needle on important metrics. Also, ensure you align these actions with your overall business strategy and get buy-in from leadership and teams.

A good benchmarking action plan will include who is responsible for each initiative, resources needed, and a timeline. Remember, the goal is not to mimic competitors blindly, but to learn from their success and innovate ways to reach or surpass that level of performance.

6. Monitor Progress and Repeat Regularly

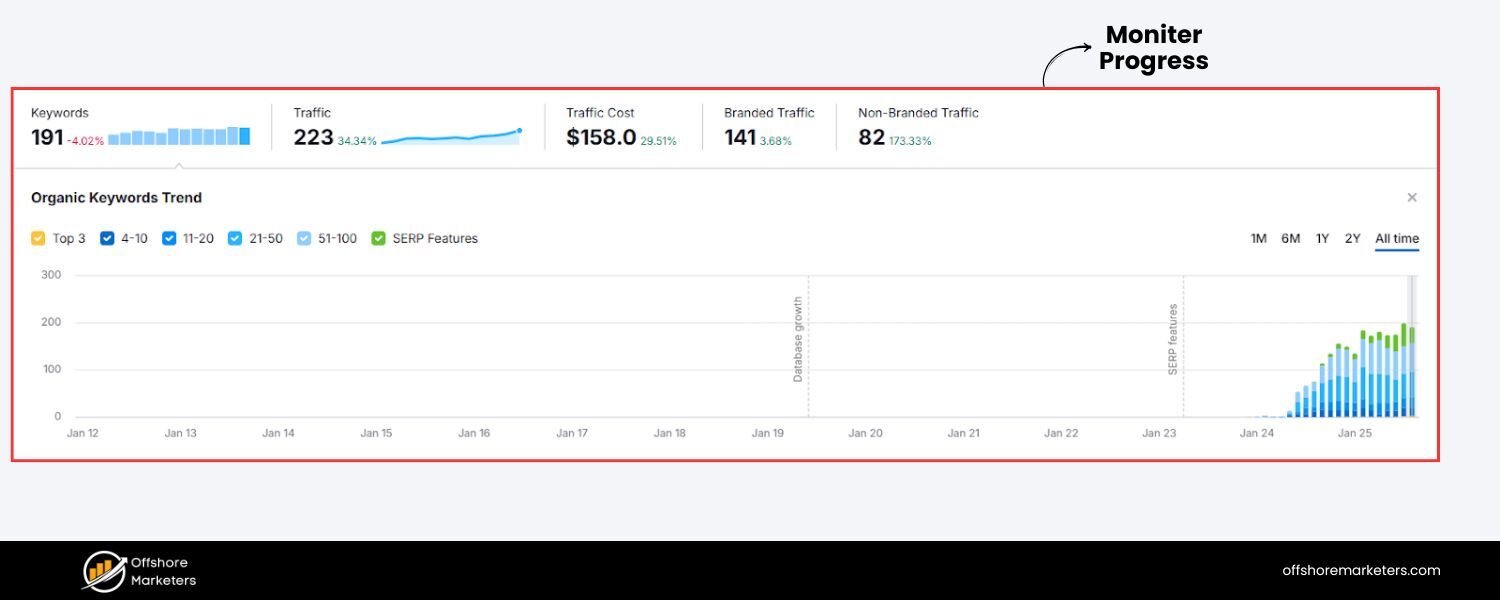

Competitive benchmarking is not a one-and-done project, it’s an ongoing cycle. After implementing improvements, continuously track the same metrics to see if your changes are yielding results.

Set up a regular cadence (e.g., quarterly or biannually) to update the benchmark data and assess progress. This will show whether the gap is closing and if you’re catching up or overtaking competitors.

It also helps catch any new changes: today’s static picture of the competition will evolve as they also improve or new competitors emerge. Ingrain benchmarking into your performance management, some companies include key competitive metrics in their dashboards or OKRs (Objectives and Key Results) to keep everyone aware of the external context.

Over time, you might refine which metrics you track, adding new ones or dropping less relevant ones as your business and industry change. The key is to keep learning and iterating. If a strategy you adopted isn’t closing the gap, revisit your action plan and try a different approach.

Likewise, if you meet a benchmark, set a new higher goal or identify another area to work on. By embracing continuous benchmarking, you ensure your company stays agile and responsive to market shifts. This continuous improvement mindset is what helps organizations not just catch up to competitors, but eventually surpass them and set new standards in the industry.

By following these steps, you create a loop of measure -> analyze -> improve -> measure again, which drives constant enhancement in your performance. In essence, you are never settling, always asking “How can we be better than we were yesterday, and better than the competition tomorrow?”

Best Practices for Effective Benchmarking

To get the most out of competitive benchmarking, keep in mind these best practices and tips:

1. Be Selective in What (and Who) You Benchmark

Benchmarking works best when it’s focused. Don’t try to benchmark every conceivable metric or every player in the industry, focus on the most relevant metrics and key competitors for your objectives.

Quality of insight is more important than quantity of data. It’s better to deeply understand a dozen critical metrics than to superficially track a hundred.

Similarly, benchmarking against a carefully chosen set of competitors (direct rivals, an industry leader, maybe an emerging disruptor) will yield more actionable insights than a broad comparison against the whole world. Too much data can cause analysis paralysis, so be strategic in your scope.

A common pitfall is misinterpreting data because of differences in definitions or contexts. Make sure the metrics you compare are defined the same way across companies.

For example, one company’s “customer” might mean active users while another’s means total signups – those numbers wouldn’t be directly comparable. When possible, use standardized definitions (e.g., annual revenue, monthly active users, etc.) and the same time frames. If comparing across regions or business models, acknowledge the differences.

In cases where exact comparisons are impossible, at least normalize the data (for instance, per employee or per store metrics can help compare differently sized companies).

Context matters too – if a competitor’s result looks way better, ask “What factors could be contributing to this?” They might operate in a different niche or have unique constraints. Always interpret benchmarks with an understanding of each company’s situation.

2. Use Reliable Sources and Validate Data

Since benchmarking relies on external data, make sure you obtain it from reliable sources. Use respected industry reports, trusted analytics tools, and official company filings when available.

Be cautious of third-party data that might be outdated or estimated, cross-verify with multiple sources if you can. If something looks surprising (too high or too low), double-check it. It can even be worth reaching out to industry analysts or using paid benchmarking services for critical metrics.

Remember, garbage in, garbage out – inaccurate data will lead to wrong conclusions. So invest time in data quality. And if you have to use assumptions or rough estimates (sometimes you must), document those and perhaps perform a sensitivity analysis (how much would an estimate have to be off to change your conclusion?). This will give you confidence that your strategic decisions are based on solid ground.

3. Look Beyond the Numbers

Quantitative metrics are the core of benchmarking, but don’t ignore qualitative insights. Try to understand the why behind a competitor’s superior metric. For example, if a competitor has a much higher customer satisfaction score, qualitative research (like reading customer reviews or case studies) might reveal they have a more user-friendly product or better support hours.

Similarly, engage your team’s industry knowledge, salespeople, account managers, and customers can often provide insight into competitor strengths and weaknesses that explain the numbers. Competitive benchmarking should spark deeper questions and learning.

Use it as a starting point for competitive intelligence: follow competitor news, observe their marketing, try their products if possible. The numbers tell you what to investigate, and deeper research tells you what actions to take.

4. Integrate Benchmarking into Planning

For benchmarking to drive real improvement, it needs to be integrated into your business planning and review processes. Consider adding competitor benchmark metrics into your performance dashboards or monthly review meetings.

When setting annual goals or OKRs, use benchmarks to calibrate targets (e.g., “Achieve 2nd place in market share in our category” or “Reduce churn to better than industry average of X%”). This keeps the team oriented not just on internal progress but external leadership.

Make benchmarking a habit for teams, for instance, your customer support team could regularly compare their service metrics with known industry benchmarks for call centers, etc. Embedding this externally aware mindset ensures you continuously strive for best-in-class performance, not just incremental internal improvement.

5. Stay Ethical and Compliant

It should go without saying, but gather competitor data ethically. Use public information, purchased reports, or authorized tools.

Do not attempt to acquire confidential information or engage in any form of corporate espionage, aside from ethical issues, unreliable clandestine data can mislead you. There’s plenty of legal competitive intelligence available openly.

Similarly, respect any regulations (some industries have restrictions on data sharing or comparisons). Ethical benchmarking focuses on publicly accessible metrics and industry standards – that’s usually sufficient to glean what you need.

6. Remember Benchmarking is a Means, Not an End

One important best practice is to not become overly obsessed with benchmarking to the detriment of innovation. As AdRoll’s marketing experts note, companies shouldn’t focus all their resources on benchmarking alone, it’s a tool to gain insights, not the ultimate strategy.

The aim is to improve your own performance and delight your customers, not just to beat a competitor on a chart. If you find yourself simply chasing competitor numbers, take a step back and ensure you’re still aligned with your unique vision and value proposition.

Use benchmarks to inform and inspire, but then tailor solutions that make sense for your business and possibly leapfrog the competition in a creative way. In other words, don’t just chase the competition, use benchmarking insights to lead the competition.

By following these best practices, you’ll avoid common pitfalls and make your competitive benchmarking efforts more effective and actionable. The result is a smarter, more informed strategy that leverages both data and insight to drive your business forward.

Conclusion and Next Steps

Competitive benchmarking is one of the most powerful techniques for continuous improvement and strategic planning in business. By regularly comparing yourself against the best in the industry, you gain an unvarnished view of your performance and a wealth of ideas for how to get better.

In this guide, we covered what competitive benchmarking is, why it’s important, the types of benchmarks you can use, and a step-by-step approach to implement it.

The key takeaway is that knowledge is power, the knowledge of where you stand and where the bar is set in your industry empowers you to make data-driven decisions to enhance your outcomes.

Now it’s time to put this into action. Start by benchmarking one or two key areas of your business against a top competitor this quarter. Assemble your team, gather the data, and identify one actionable insight to pursue.

You might be surprised by what you uncover, perhaps a competitor’s new strategy explains their recent surge in sales, pointing you to adapt your approach. Or you may find you’re actually leading in an area, which you can double down on as a differentiator.

Remember, the goal isn’t to mimic competitors, but to learn from them and then innovate beyond them. Use competitive benchmarking as a springboard for creativity and improvement.

Over time, as you consistently benchmark and improve, you will close performance gaps and potentially open up a lead where others start benchmarking against you!

In a fast-moving market, those who refuse to learn from the competition risk falling behind. But that’s not going to be you.

You now have the knowledge to measure your company against the best, identify what it takes to win, and make the changes needed to get there. So, set your benchmarks high and go out there and outshine your competition.

Your future market-leading self will thank you.

.png)

.png)

.png)

.png)

.png)

.png)