Share of Search: What It Is & Why It Matters

July 14, 2025

Introduction

Imagine being able to predict your future market share just by analyzing what people search on Google. That’s the promise of share of search, a rising star metric in marketing analytics.

Share of search measures how often consumers search for your brand compared to your competitors, offering a real-time window into brand awareness and interest. Marketers are excited about share of search because it’s simple to track yet remarkably insightful.

In fact, early studies by MyTelescope found an average 83% correlation between a brand’s share of search and its share of market. In other words, if your share of search is growing, your sales are likely to follow.

In this comprehensive guide, we’ll explain exactly what share of search means, how it differs from metrics like share of voice, why it’s so important for your business, and how you can measure and increase your share of search to outshine the competition. Let’s dive in!

What is Share of Search?

Share of Search (SoS) is the percentage of all search engine queries in your product category that are about your brand. In practical terms, it’s a way to gauge how popular your brand is in search relative to competitors.

If 10,000 people search for your brand this month out of 50,000 total category searches (including rivals’ brand names), your share of search would be 20%.

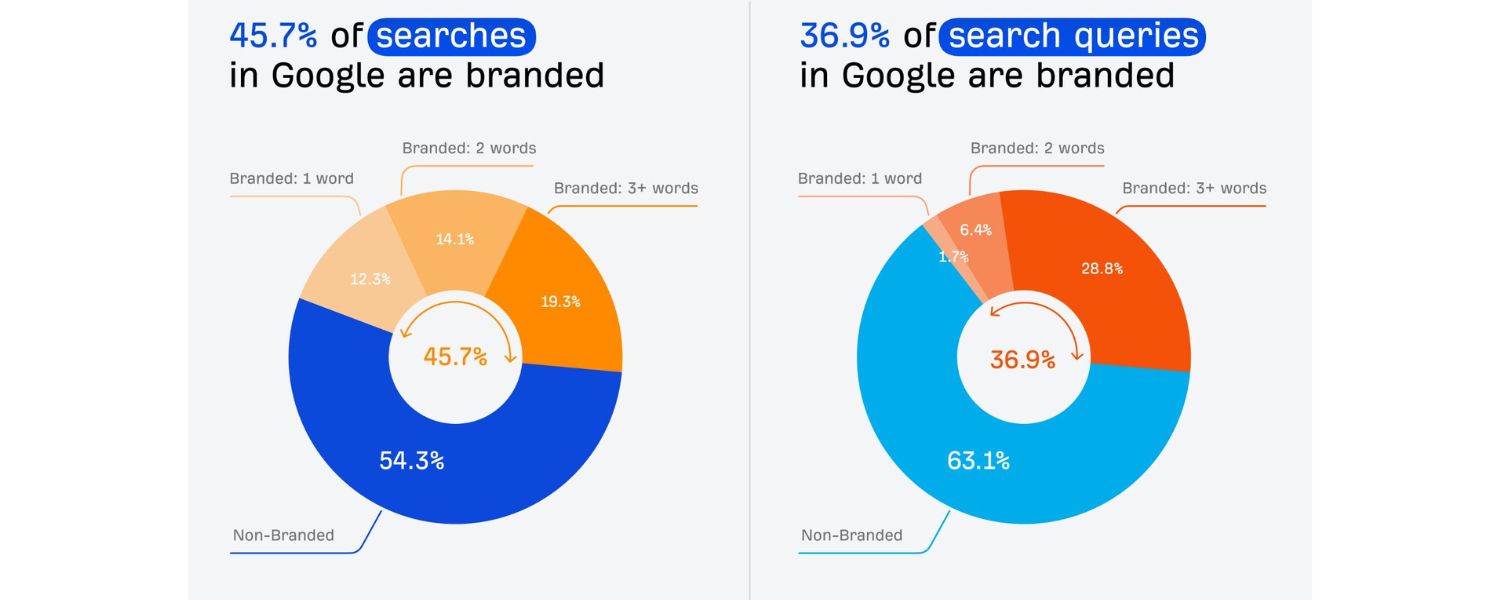

It focuses on branded searches, queries where someone specifically types your brand name (or product names associated with your brand) into Google or another search engine.

This metric captures consumer interest and intent: people are actively seeking your brand information, which often signals strong awareness or consideration.

The concept of share of search was popularized around 2020 by marketing strategists Les Binet and James Hankins.

They proposed that tracking branded search volume can serve as an “indicator of brand demand,” often predicting changes in market share before sales numbers do.

Because it’s based on actual search behavior (rather than surveys or spend data), share of search offers fast, tangible feedback on how well your brand marketing is working.

If more people are searching your brand this month than last, it’s a good sign your latest campaigns or word-of-mouth are raising awareness.

If your branded searches are dropping, it may warn that consumers are losing interest or shifting to competitors, a signal to take action before it shows up in revenue.

In summary, share of search tells you what percentage of consumer interest in your category is going to you versus others.

It condenses brand awareness into a single number that’s easier to track over time and compare against rivals.

Share of Search vs. Share of Voice vs. Share of Market

It’s easy to confuse share of search with other “share of…” metrics, so let’s clarify how they differ from the two other common ones: share of voice (SoV) and share of market (SoM).

All three metrics relate to your brand’s standing against competitors, but they measure different things:

1. Share of Voice (SoV)

Traditionally, share of voice refers to your brand’s proportion of advertising presence or media spend in the market.

For example, if you account for 25% of all industry ad spend or impressions, you have 25% share of voice. It’s essentially “how loud” your brand is in marketing channels (ads, PR, social media, etc.) compared to rivals.

SoV was long used as a predictor of market share – the idea being, the more you spend on ads, the more market share you gain.

However, in the digital age its power has faded a bit, as media is fragmented and paid exposure ≠ guaranteed consumer attention in many cases.

2. Share of Search (SoS)

This measures brand visibility in organic searches – specifically, the percentage of total branded search queries in your category that are for your brand.

Unlike share of voice (which inputs marketing spend), share of search reflects outcomes of all marketing efforts by capturing actual consumer interest.

It’s considered a leading indicator: if people are searching your brand more, it likely means your marketing (or product buzz) is working and you may see sales lift next.

SoS is also far easier to measure regularly than share of voice or market share, since you can pull search data on-demand.

3. Share of Market (SoM)

Often just called market share, this is the ultimate business metric – the percentage of total sales in your industry or category that your company commands.

For instance, if you sold 15 out of every 100 smartphones last quarter, you have 15% market share in smartphones. Market share is the bottom-line result that all your marketing and branding aims to influence.

Both SoV and SoS can be predictors of SoM: a company with a larger share of voice tends to gain market share over time, and a rising share of search often foreshadows growth in sales.

Another way to look at it: Share of voice is about what you put out, share of search is about what consumers do (their behavior), and share of market is about what you get (sales).

Importantly, share of search correlates strongly with share of market – making it a valuable proxy for brand performance.

For example, one analysis found an 83% correlation between share of search and share of market across various categories.

That means if you’re outperforming competitors in search interest, there’s a good chance you’re also leading (or soon will lead) in market share.

Why Share of Search Matters for Your Brand

Share of search has quickly become a go-to metric for marketers and brand managers, and for good reason. Here are the key reasons why tracking share of search is so important:

1. It’s a barometer of brand awareness and interest

Simply put, people can’t search for a brand they aren’t aware of. If your share of search is high, your brand awareness is likely high too.

A rising share of search means more consumers remember or prefer your brand enough to specifically look for it, a clear sign of brand momentum.

In fact, marketing experts call share of search “one of the most meaningful indicators of brand relevance and momentum” because it shows a shift from generic interest to branded search (searching you by name). That indicates your brand is breaking through the noise.

2. It’s a leading indicator of sales and market share

Unlike market share (which is lagging and often only known after quarterly reports) or brand surveys (which are slow and costly), share of search provides quick, real-time feedback on consumer demand.

Multiple studies have shown that as share of search rises, market share tends to rise in the following months. That strong correlation (around 0.83 on average) means you can use SoS trends to predict future sales with surprising accuracy.

For example, if your brand’s search interest jumps after a new campaign, you can anticipate an uptick in customers soon. Conversely, if your SoS starts declining, it’s a warning sign to address issues before they hit revenue.

3. It reflects the impact of marketing and PR campaigns

Share of search is one of the best ways to measure the effectiveness of broad marketing efforts that aren’t directly tied to clicks or immediate conversions.

Big splashy campaigns – TV commercials, billboards, viral social media stunts, PR events – often have a primary goal of boosting brand awareness.

The payoff from these is hard to measure with direct sales alone, but if they work, you’ll see a spike in branded searches.

For instance, one agency found that when they ran a heavy TV ad campaign for a client, the brand’s share of search jumped dramatically and stayed 15–20% higher year-on-year even after the TV ads ended.

This illustrates that increased share of search = increased brand salience, and that the gains can persist over time as more people remember the brand.

4. It complements your SEO strategy and reveals brand health in search

In the SEO world, we often focus on ranking for generic keywords, but branded search traffic is gold. Visitors who search your brand name are much more likely to convert than those who find you with a generic query.

So a growing share of search means not only more traffic, but higher-quality traffic that already trusts your brand. Tracking SoS helps SEO and content teams monitor how well their efforts are boosting brand recognition online.

For example, if an SEO campaign improves your overall content and PR presence, you should see more people searching your brand (because they discovered you through an article or referral). A higher share of search, in turn, often translates to better click-through rates and conversion rates, since branded queries tend to lead to your site where you likely rank #1.

5. It’s easy, timely, and cost-effective to track

Unlike traditional brand surveys or expensive market research, figuring out your share of search doesn’t require huge budgets or long waits.

All you need is access to search volume data, which many free or affordable tools can provide, and you can calculate this metric anytime. You can monitor it weekly or monthly and quickly see the impact of marketing experiments.

The data comes straight from consumer behavior (search engines), so it’s more objective and immediate than awareness polls.

As one expert put it, “share of search allows you to easily check and track brand awareness in Google at any given time… without difficult calculations or costly surveys”. In short, it’s a practical KPI for brands of all sizes to gauge their traction.

By now, it should be clear that share of search is much more than a buzzword. It’s a versatile metric that acts as early warning radar for your brand’s performance.

Whether you’re a marketer looking to justify a campaign, an executive tracking brand health, or an SEO pro proving the value of branding, SoS offers tangible data on how you’re faring in the battle for consumers’ minds and wallets.

How to Measure and Calculate Share of Search

Measuring your brand’s share of search may sound complex, but it’s actually straightforward. The basic formula for share of search is:

Share of Search (%) = (Branded search volume for your brand ÷ Total branded search volume for all brands in your category) × 100

To break it down in steps:

1. Define your category and competitors

Decide which brands or keywords make up the “market” you want to measure. For a broad industry, you might include all major players.

If you want a more specific view (e.g. a niche product line or a local market), include just those direct competitors. For instance, if you’re measuring a car brand’s SoS, you’d include your brand name and those of your key competitor car brands.

2. Gather search volume data for each brand term

You need to find out how many searches each brand gets, typically on a monthly basis. There are a few ways to get this data:

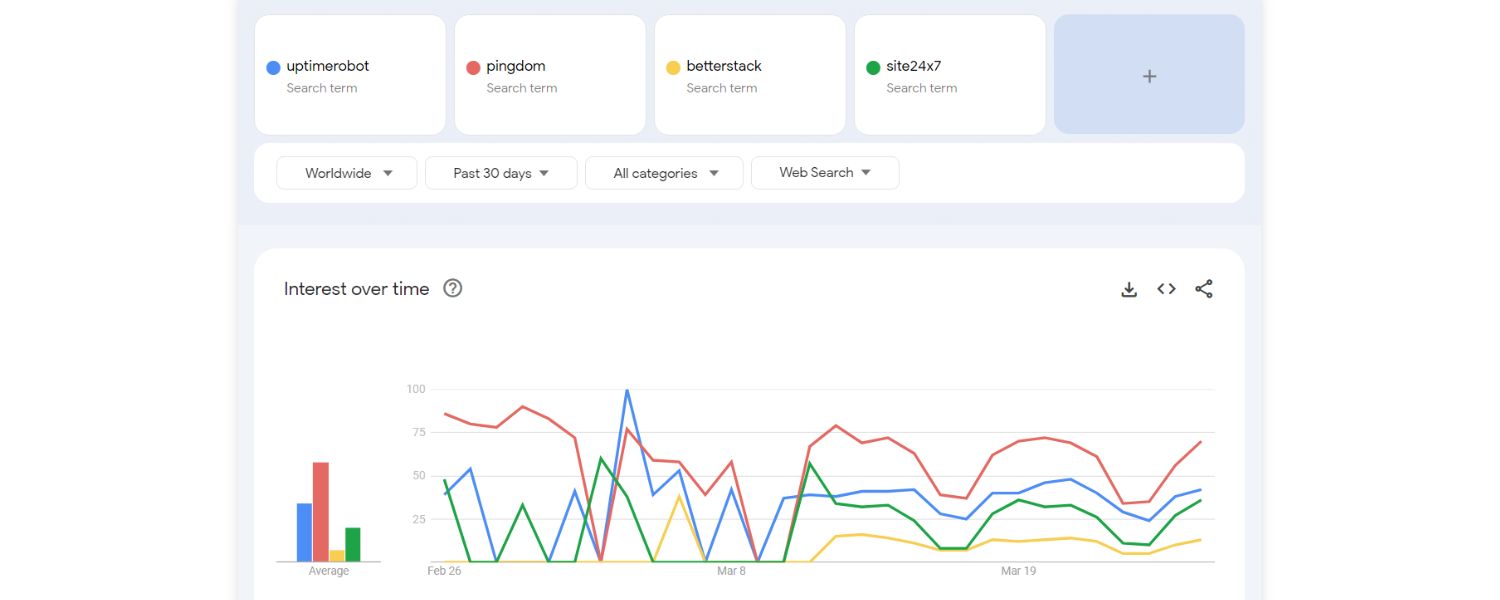

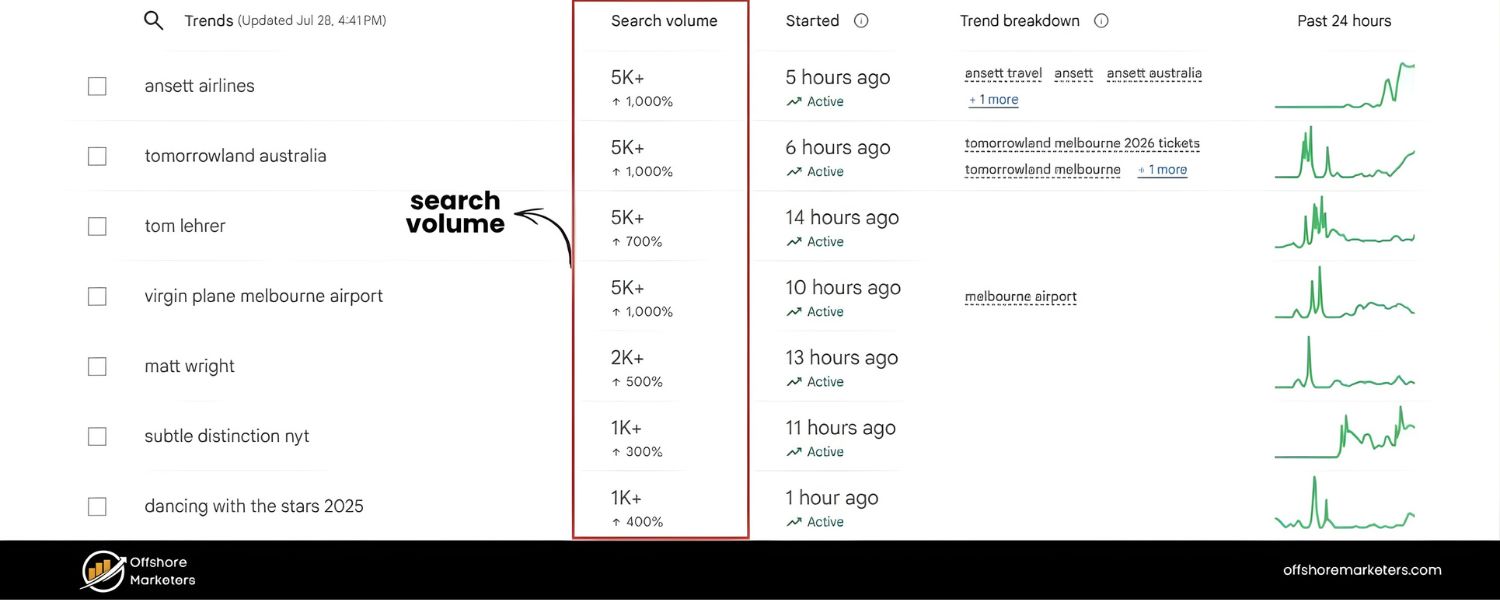

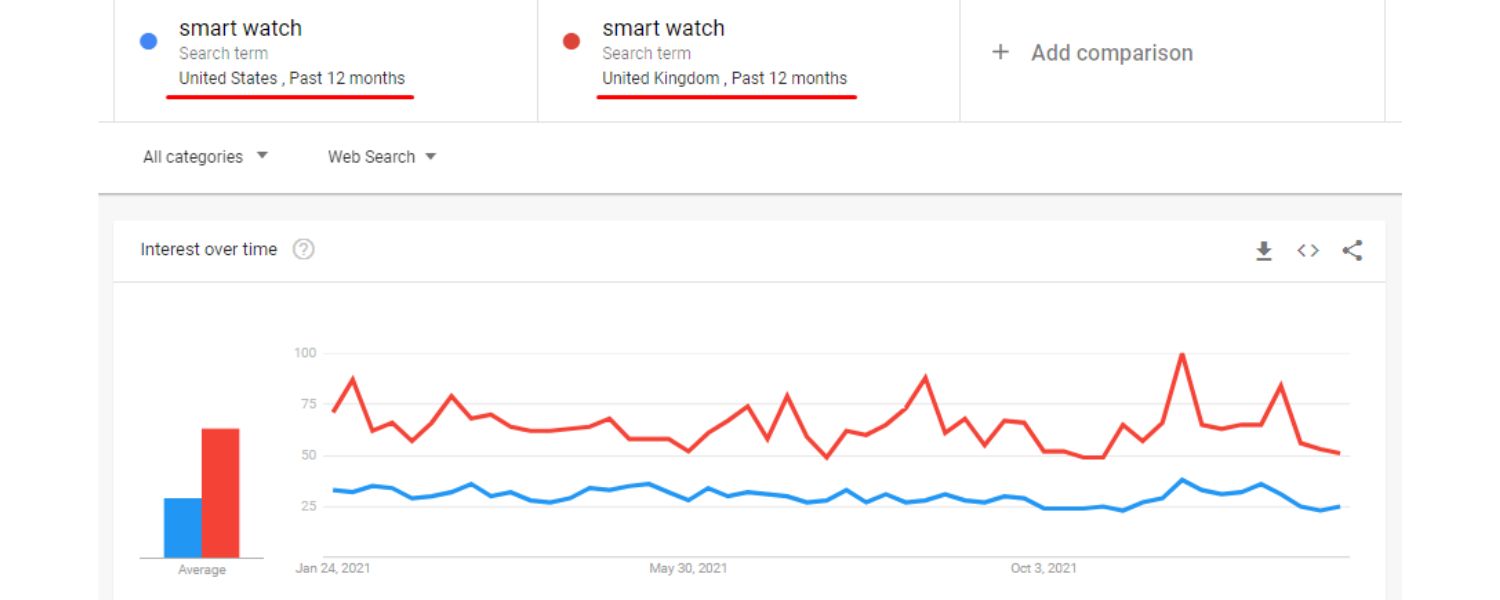

A. Google Trends (free)

Google Trends can show relative search interest over time for up to five terms. You can enter your brand name and competitors’ names to see how interest compares.

This is great for spotting trends (e.g. who is searched more over time). However, Google Trends gives relative indices (0 to 100 scale) rather than exact volumes, and it may misinterpret or miss certain brand terms.

Still, it’s a quick starting point to gauge share of search changes and can be refined with other data.

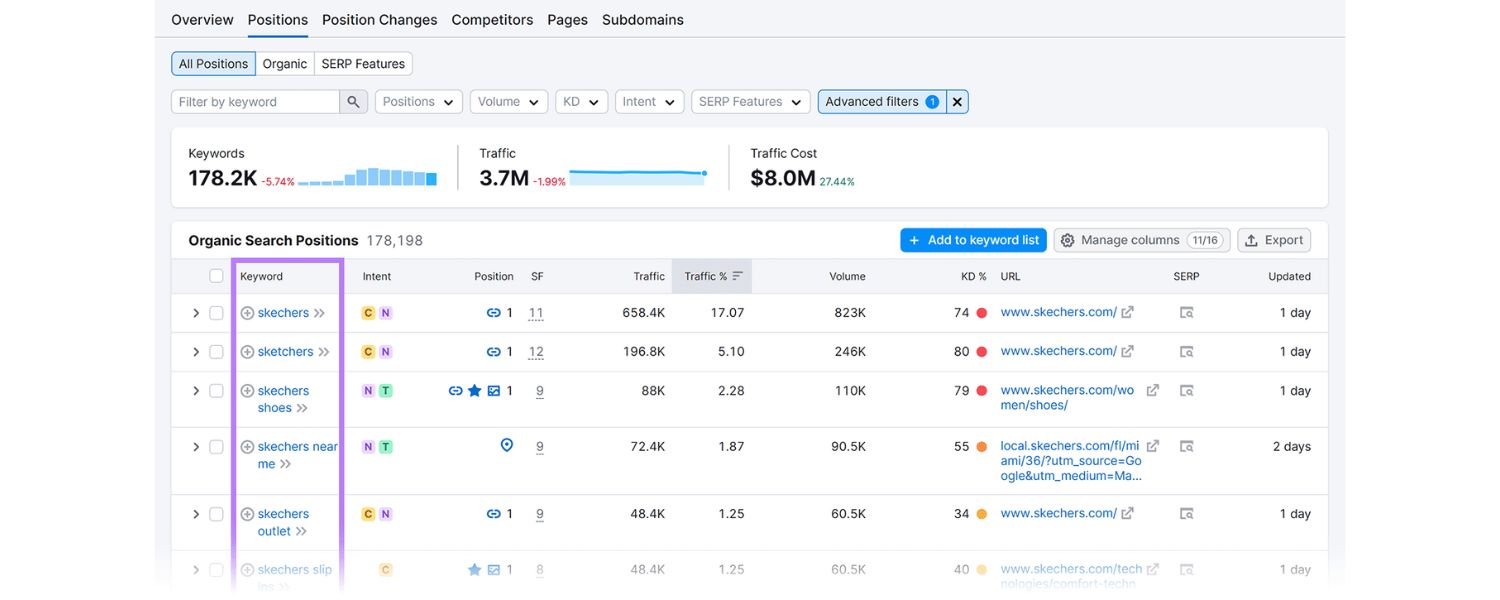

B. Keyword research tools

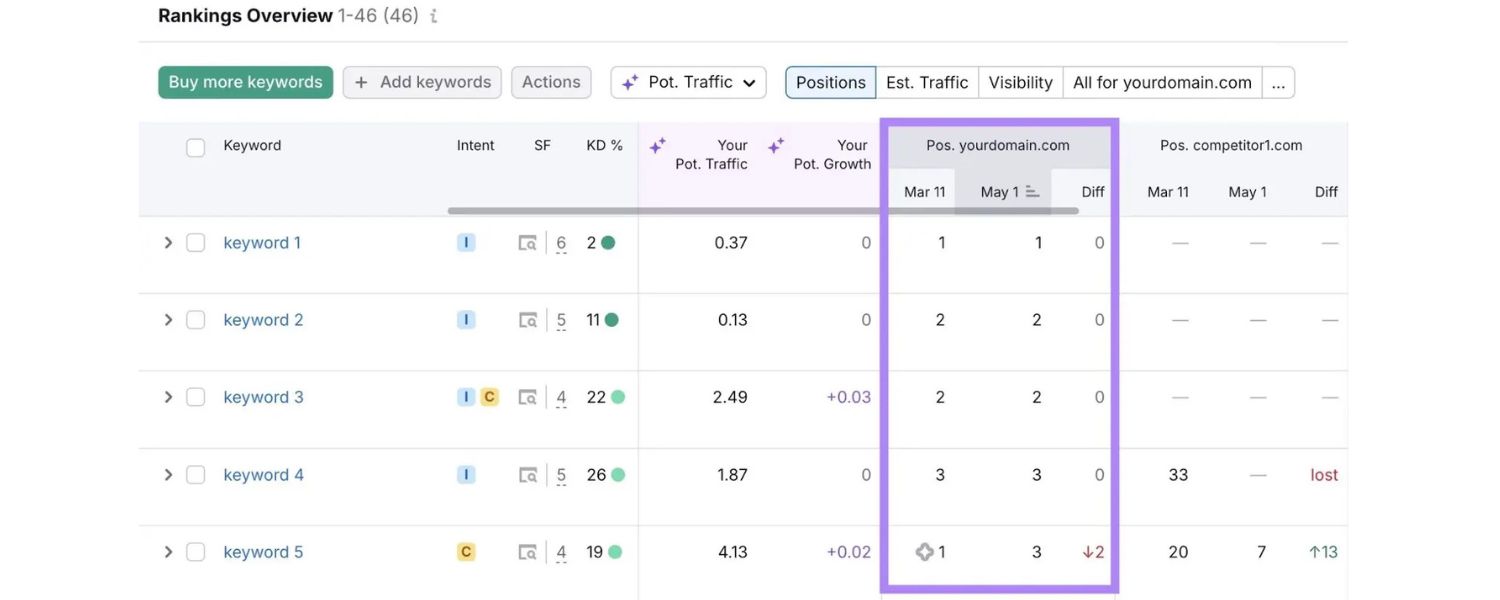

SEO tools like Semrush, Ahrefs, or Google Keyword Planner provide estimated monthly search volumes for specific keywords. For example, you can use a Keyword Overview tool to get the average monthly searches for each brand name in a given country.

Enter each competitor’s brand name as a keyword and note the search volume. These tools give more precise numbers than Google Trends.

Ahrefs’ Keywords Explorer or Semrush’s database can also sum up all variations of branded searches (including misspellings or secondary brand terms) to give a comprehensive volume.

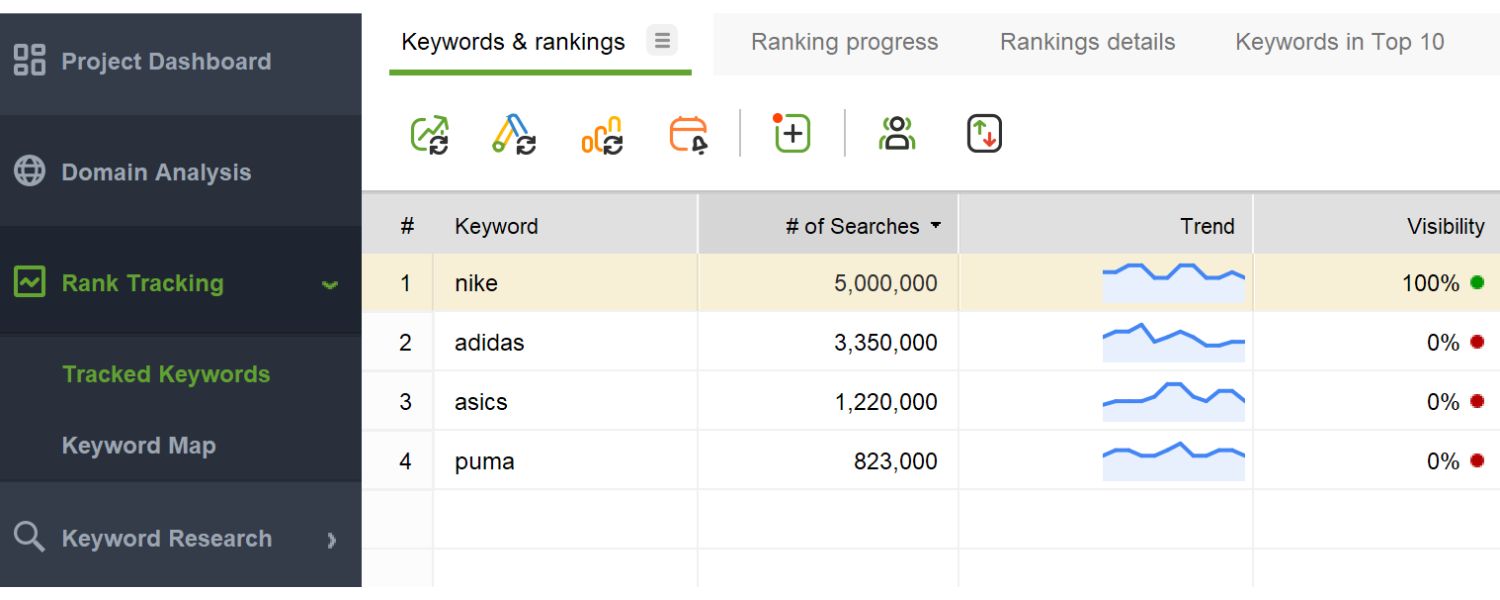

Some platforms even automate this: Ahrefs, for instance, can calculate SoS if you input your brand and competitors in their Rank Tracker.

C. Share-of-Search dedicated tools

There are emerging tools specifically for tracking share of search. For example, Mangools offers a free Share of Search tool where you plug in multiple brands and it calculates their proportions automatically.

Another platform, MyTelescope, focuses on share of search for brand tracking. These tools often provide nice visuals and historical data, but you can also accomplish the same with manual data gathering and a spreadsheet.

3. Calculate the percentage

Once you have the search volume numbers for each brand, simply add up the total and divide your brand’s figure by the total. Then multiply by 100 to get a percentage.

For example, say in July the searches were: YourBrand = 20,000; CompetitorA = 15,000; CompetitorB = 10,000; CompetitorC = 5,000. Total = 50,000.

Your share of search = 20,000 / 50,000 = 0.4, i.e. 40%. That means 40% of all branded searches in your category were for your brand. You can visualize this as a pie chart of the “mindshare” each brand holds in search.

4. Track it over time

It’s crucial to look at share of search as a trend, not a one-off number. Calculate it monthly or quarterly and plot it over time. Are you gaining share or losing it?

Do spikes coincide with campaigns or news? Regular tracking lets you connect the dots between marketing efforts and search interest.

For example, you might see your SoS jump 5 points after a product launch PR blitz, then slowly settle, or notice a competitor’s share surging due to their viral campaign, alerting you to respond.

Pro Tip: When gathering search data, make sure to consider variations of brand keywords. Many brands have abbreviations, nicknames or sub-brands that people search for.

Also, if a brand name is generic (e.g. “Apple” or “Delta” which have multiple meanings), use filters or tools (like Ahrefs’ Parent Topic feature) to isolate queries that truly refer to the brand.

This prevents unrelated searches from skewing the results. The more accurate your input data, the more reliable your share of search metric will be.

Strategies to Increase Your Share of Search

Measuring share of search is only half the battle, the real question is, how can you increase it? In essence, improving share of search means getting more people to search for your brand.

This typically happens when you boost overall brand awareness, credibility, and visibility in places that drive consumers to look you up.

1. Create content that builds awareness (Content Marketing & SEO)

A fundamental way to get more branded searches is to first attract people with non-branded content so they discover your brand.

By publishing high-quality, search-optimized content on topics in your niche, you can capture consumers researching those topics and introduce them to your brand.

For example, an SEO agency improved a hair clinic’s share of search by creating blog pages for specific queries like “African American hair transplant NYC” – this content ranked in Google and brought in visitors who later started searching directly for the clinic’s brand.

Think about problems or questions your target audience has (that don’t involve your brand name yet). Create authoritative articles, videos, or guides addressing those.

As users encounter your helpful content, they become familiar with your brand and are more likely to search for you by name later. This content-led approach steadily converts generic searches into branded ones as you become known as a go-to resource.

2. Leverage “Surround Sound” and third-party mentions

Don’t rely solely on your own site to spread your name. Surround Sound SEO is a strategy of getting your brand mentioned on other high-ranking websites for relevant industry keywords.

When your brand appears in top-10 lists, reviews, comparisons, or press articles, readers of those pages may curiously search for your brand afterwards.

One case study in the UK sportswear market found that by ensuring the brand was featured in multiple “best running shoes” and “affordable gym wear” listicles on popular sites, their share of search jumped from 18% to 32% within a year.

To do this, pitch your brand to writers and publishers of relevant content, offer expert quotes, provide product samples for review, or partner with influencers/blogs.

The more your brand is seen wherever consumers are researching products, the more it stays top-of-mind. When they’re later ready to take action, they’ll likely search for your brand directly (instead of a generic term).

3. Run campaigns that spark curiosity and conversation

Big branding campaigns (advertising, viral stunts, PR events) can deliver spikes in share of search – sometimes overnight.

The key is to execute campaigns that are memorable and buzz-worthy enough that people feel compelled to learn more about your brand (often via a Google search).

A great example is Duolingo’s viral social media campaign in early 2025 where they “announced” the death of their owl mascot as a quirky story.

This campaign caused the term “Duolingo” to hit an all-time high in Google searches during that period. The lesson: give people a reason to talk about (and search) your brand.

It could be a clever Super Bowl ad, a challenge or hashtag on social media, a controversial opinion in an industry publication – anything that generates brand curiosity.

When planning marketing initiatives, include KPIs like increase in branded search volume as a measure of success. If done right, a single campaign can boost your share of search and then your ongoing efforts can keep it elevated at a new normal.

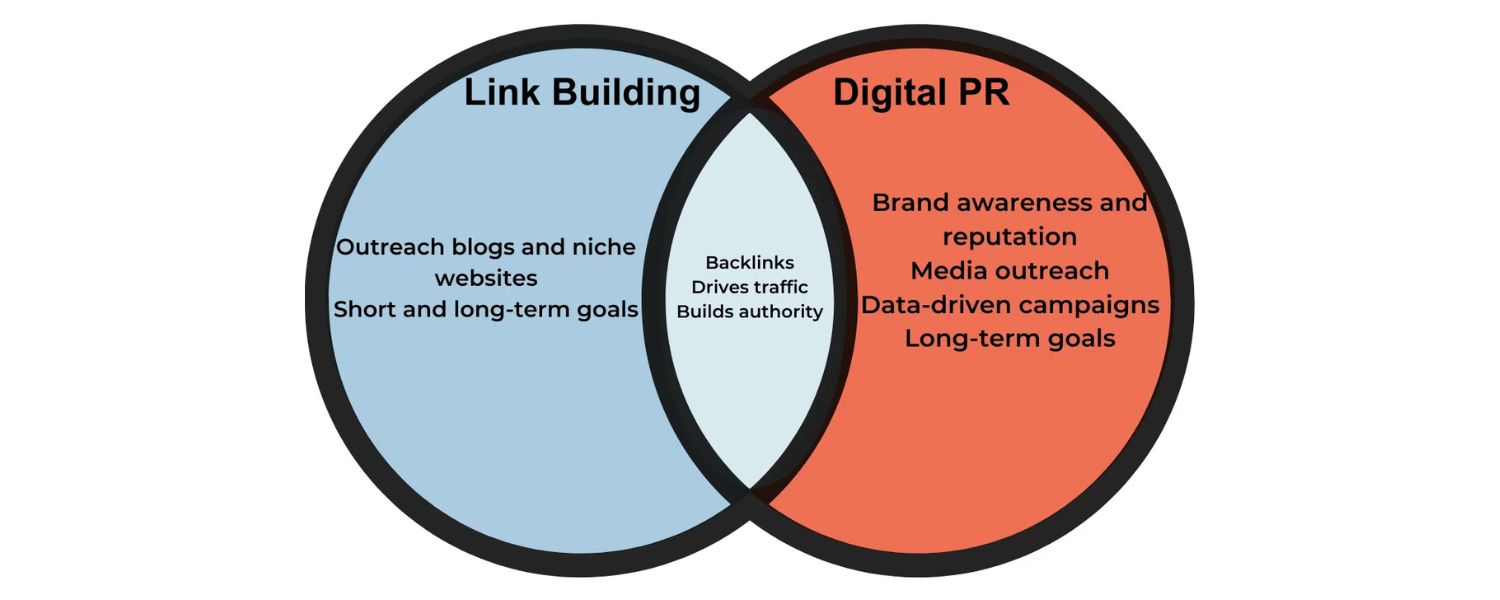

4. Invest in digital PR and link-building

Public relations (PR) isn’t just about getting news coverage, it’s a way to put your brand’s name on high-authority platforms, which can both improve SEO and drive branded searches.

When your company is mentioned in a popular news site, magazine, or blog (especially with a backlink), it exposes your brand to new audiences. Some of those readers will click the link immediately; others might just remember the name and search it later.

For instance, if your SaaS startup gets featured in TechCrunch or your fashion product is mentioned in Vogue, expect a surge in Google searches for your brand that week.

Digital PR tactics include press releases, contributing thought leadership articles, being a guest on podcasts or webinars, and using services like HARO to get quoted as an expert.

All these increase your brand’s reach and credibility. Plus, as a bonus, backlinks from reputable sites improve your SEO, which can lead to higher rankings and more organic traffic, feeding back into greater brand awareness over time.

5. Use competitor insights to find gaps

Sometimes the fastest way to boost your share of search is by analyzing why competitors might be getting more searches and then outdoing them.

Use SEO tools to see what sites or content mention your competitors. For example, Ahrefs’ Site Explorer can show you which websites are linking to or talking about your competitor but not you.

If you discover, say, that your competitor is often cited on niche forums, or has been reviewed by certain YouTubers, those are opportunities for you to also appear there. Reach out to those sources and introduce your brand or pitch your product for review.

Likewise, set up alerts (e.g. Google Alerts or Ahrefs Alerts) for when competitors are mentioned in the news or on new web pages.

This way, you can quickly engage with those publications or publish response content on the same trending topics, aiming to get your brand included in the ongoing conversation.

By systematically closing these “mention gaps,” you make sure potential customers hear about you wherever they hear about competitors, increasing the likelihood they’ll search for you as well.

6. Optimize the experience for those who search your brand

Finally, don’t overlook converting the interest from the people who do search for you. To truly capitalize on a growing share of search, ensure that when someone Googles your brand, they find what they need quickly and easily.

This includes having an up-to-date, well-maintained website that ranks first for your brand name and navigational queries (which it should if you’ve done basic SEO).

Make sure your site’s homepage and key pages (pricing, product info, support, etc.) are obvious for anyone searching “[YourBrand] + [need]”. For example, if you notice people often search “YourBrand return policy” or “YourBrand vs CompetitorX,” consider creating clear pages answering those.

The smoother the journey for a branded searcher – from search results to finding information to potentially converting – the more your marketing efforts will translate into actual business.

Also, a good brand search experience reinforces the positive impression (so they don’t bounce and search a competitor out of frustration). While this may not directly increase the number of searches, it ensures the increased interest you generate isn’t wasted.

Each of these strategies works in tandem: content brings new prospects into your funnel, PR and surround-sound increase touchpoints, campaigns spike broad interest, and a seamless web presence captures and converts that interest.

Over time, these efforts create a virtuous cycle – higher brand visibility leads to more searches, which leads to more people discovering and choosing your brand, which then leads to even higher search interest.

Keep in mind that improving share of search is typically a long-term game (aside from short-lived campaign spikes).

It tracks the cumulative effect of all your marketing and brand-building. Stay consistent and patient, and you’ll see that share of search line move upward.

Limitations and Caveats of Share of Search

Like any metric, share of search isn’t perfect or all-powerful. It’s important to understand its limitations and use it in the right context.

1. Not all brands fit neatly into SoS

The metric works best when brands have distinctive names and operate in a defined category. If your brand name is very common or generic, the search data can get noisy or misleading.

For example, a furniture brand named “Emma” will see search results mixed with people’s first names, or a brand like “Apple” includes many unrelated fruit or other uses. Even misspellings and abbreviations (think “Coke” vs “Coca-Cola”) can complicate measurement.

On the flip side, brands that are extremely large and diversified can also pose a challenge, e.g., “Amazon” could include searches for their AWS cloud service, e-commerce, Kindle, etc., all lumped under one name.

If you try to compare Amazon’s SoS to smaller single-category competitors, it’s not apples-to-apples. In such cases, you might need to narrow down to specific product lines or use advanced filtering in tools to get meaningful data.

2. Small or new brands may have zero search presence

Share of search is less useful if you’re just starting out or have minimal brand awareness. A brand that launched last week won’t have any notable search volume yet – so it could falsely show 0% share of search even if the brand is poised to grow.

If no one’s searching your name yet, focus on building awareness through generic keywords and other channels first (basically, you have to earn a baseline SoS).

In early stages, it might be more useful to track things like overall organic traffic or social buzz until branded search volume picks up.

3. A high share of search doesn’t always equal purchases

Remember that interest and intent are related but not identical. Some people searching your brand may not be potential customers. For example, existing customers might search your site for support or documentation, which inflates branded search volume without indicating new sales opportunities.

Or a surge in searches might come from a curiosity-driven viral moment that doesn’t convert to revenue (everyone might search for “BrandX controversy” due to news, but not actually buy anything).

So, while an increasing SoS generally signals good things, qualitative context matters. You may want to segment branded searches into those with high commercial intent (like “Buy BrandX” or “BrandX pricing”) versus informational or navigational searches. This can help you tell if the interest is likely to lead to sales.

4. Tool limitations and data accuracy

Different tools may give slightly different search volume numbers. Google Trends shows relative interest and can misinterpret terms. Keyword planners might have sampling or data lag issues.

Also, share of search usually focuses on Google search; it might ignore other search engines or platforms. If your audience heavily uses YouTube, Amazon, Bing, etc., those “searches” aren’t counted in a typical SoS calculation (unless you specifically track them).

Treat SoS as a directional metric, not an exact science. Small percentage differences shouldn’t be overhyped, focus on clear trends and big moves.

It’s also wise to double-check with multiple sources (e.g. compare Google Trends and an SEO tool) to ensure a spike or drop is real and not a data anomaly.

5. External factors can skew short-term results

A sudden news event, seasonality, or even a competitor’s crisis can temporarily swing search volumes in ways unrelated to your marketing.

For instance, if a competitor faces a scandal, their brand searches might spike (people reading the news), which mathematically could lower your share of search that month even though nothing changed with your brand.

Or annual holiday seasons might boost searches for certain brands briefly. Keep an eye on the context around any SoS change.

If you see a weird blip, investigate whether it was due to an external spike in someone else’s searches or a fleeting trend. Correlate SoS data with real-world events to interpret it correctly.

6. Shouldn’t be used in isolation

Share of search is best used alongside other metrics. It tells you about brand interest, but not everything about brand health or marketing success.

For a full picture, consider metrics like direct website traffic (are more people visiting you directly?), social media mentions, brand survey scores (like awareness or consideration from polling), and of course actual sales and conversions.

If all indicators are up, you’re in great shape. If SoS is up but sales aren’t, you might have an issue converting that interest into action.

Conversely, if sales are up but SoS isn’t, perhaps you’re squeezing more revenue from existing fans but not expanding your audience. Use SoS as a critical piece of the puzzle, not the sole dashboard gauge.

In short, share of search is a powerful yet imperfect tool. It offers a unique peek into consumers’ minds by leveraging organic behavior.

By understanding what it can and cannot tell you, and by carefully cleaning and interpreting the data, you can avoid missteps and extract maximum value from this metric.

Using Share of Search Insights in Your Strategy

When tracked and analyzed over time, share of search data can inform several aspects of your marketing and business strategy. Here are a few ways to leverage share of search insights:

1. Validate brand strategy and positioning

If you launch a new brand campaign, enter a new market, or change your messaging, watch your share of search in the following weeks and months. An uptick in branded searches is an early sign your strategy is resonating.

For example, if you expand to a new region and see your SoS in that region climb from 2% to 5%, it means people are hearing about you. Share of search acts as a pulse check on brand fit before sales data comes in.

2. Monitor marketing campaign momentum

Track SoS during major marketing pushes (product launches, seasonal promotions, etc.). If you’re combining broad-reach tactics (like TV ads or viral social content) with targeted content, you should see compounding growth in branded search volume as more people move down the funnel.

By plotting SoS weekly during a campaign, you can gauge how quickly audience interest is building. If the needle isn’t moving, it might indicate the campaign isn’t breaking through, prompting a pivot in messaging or media mix.

3. Spot competitive shifts early

By comparing your share of search trend against competitors, you can identify who is gaining ground and who is losing, often before it shows up in market share or revenue reports.

If you notice a competitor’s SoS line sharply upward, something is working for them, perhaps a new product or aggressive marketing, and you may need to respond to avoid losing mindshare.

Similarly, if a rival’s share of search dips, it could be an opportunity to capitalize. This is especially useful around seasonal events or big product launches, you can see in near real-time which brand is winning the battle for consumer attention.

Essentially, SoS trends let you react to market changes faster, informing competitive strategy (like ramping up marketing if you’re slipping, or doubling down if you’re surging ahead).

4. Measure long-term brand building impact

Share of search is an excellent yardstick for brand equity growth over the long term. Branding efforts (sponsorships, community engagement, brand storytelling) might not have immediate payoffs in sales, but they should gradually increase how often your brand comes to consumers’ minds.

By tracking your SoS quarter over quarter, year over year, you can see if those deeper brand investments are paying off. The real insight comes from comparing against competitors: if your share of search rises while competitors’ remain flat, it’s a strong signal that your brand building is outperforming theirs.

On the flip side, if everyone’s share of search is rising (because the whole category is getting more interest), you’ll know your growth is part of a bigger trend rather than purely your own doing. This helps in evaluating whether your marketing is truly moving the needle in a crowded market.

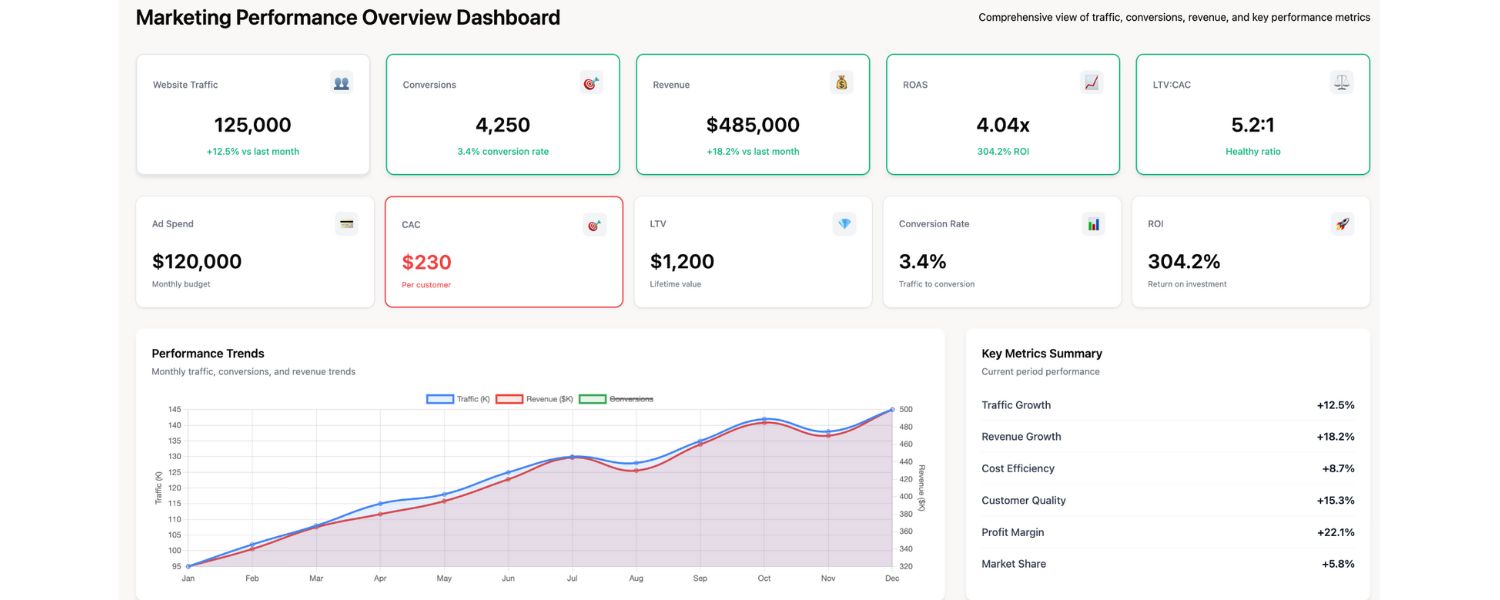

Incorporating share of search into your KPI dashboard brings a customer-centric perspective to your strategy. It forces you to think in terms of winning hearts and minds, not just transactions.

Used wisely, it can guide decisions on where to invest marketing dollars, how to refine messaging, and even when to launch new initiatives (for example, you might aim to reach a certain SoS percentage before introducing a new product, to ensure a baseline level of brand interest).

Conclusion

In the fast-evolving world of digital marketing, share of search has emerged as a vital metric that sits at the intersection of brand marketing and performance marketing.

It’s not a vanity number, it’s grounded in real consumer behavior and has proven links to business outcomes. By tracking how much of the conversation your brand owns in search, you gain a powerful early indicator of success or trouble.

Remember, no metric is perfect, but share of search gives you a unique window into the mindshare your brand holds, which is incredibly valuable in crafting effective marketing strategies.

Now it’s time to put these insights into action. Start by measuring your own share of search: identify your top competitors, gather some search data (try the tools and techniques mentioned above), and see where you stand.

Is your share of search where you want it to be? If not, revisit the strategies we discussed, from content marketing to PR to surround-sound SEO, and identify which tactics can best increase your brand’s visibility and appeal.

Set concrete goals (e.g. “Increase our share of search from 10% to 15% in the next 6 months”) and regularly monitor your progress.

.png)

.png)

.png)

.png)

.png)

.png)